Retirement Benefits Overview

No. Your Social Security retirement pay is taken from the average wages reported – this includes what you receive from both years you earn all four credits and years you earn less (this is why retirement AGE matters).

If you stop working prior to starting benefits, this will reduce your benefits as they are determined based on your entire work history. Likewise, if you start drawing benefits early, you will permanently have a reduced benefit.

We can’t directly answer that, but Social Security benefits are designed to replace a percentage of your pre-retirement income. The amount it replaces varies from as high as 75% (for very low-income earners) to as low as about 27% (for very high-income earners) if you reach full retirement age.

If you suffer from health problems and are unable to work, consider applying for Social Security disability payments. The disability payment is the same as a full, unreduced retirement benefit and will be converted to retirement benefits once you reach full retirement age.

You should apply for benefits about 4 months prior to when you want them to start.

Maybe. Single filers are taxed if combined income is over $25,000. Married filing joint are taxed if combined income is over $32,000. You can request voluntary federal withholding on your Social Security benefits to be safe.

Example of How Age & Credits Affect SS Retirement Amounts

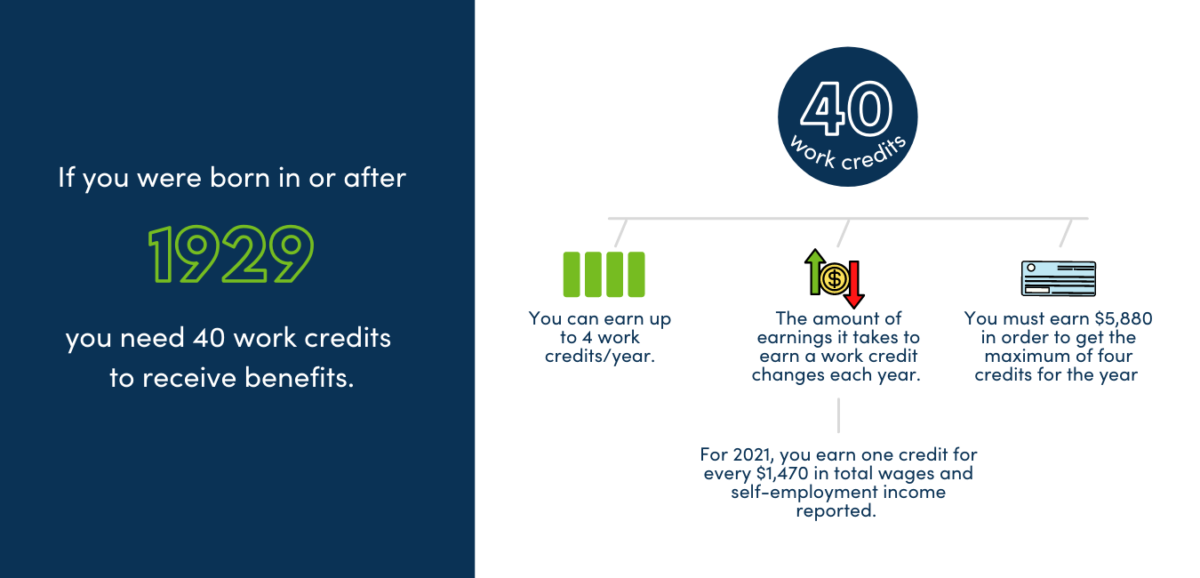

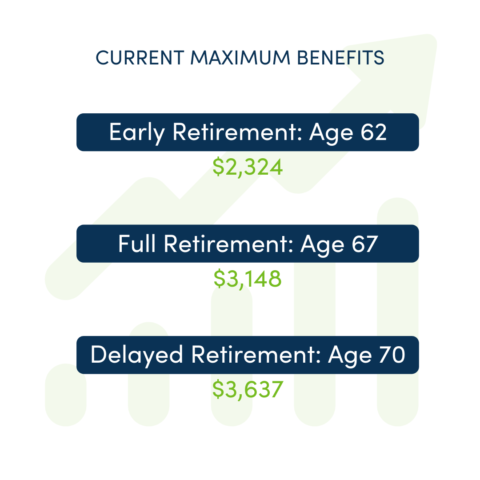

Your Social Security benefit amount is tricky to calculate and the maximum benefit amounts listed on the right are the highest amount you can receive, but just because you’ve worked 40 years does not mean that’s the amount you’ll get. You have to calculate both the average of credit earned as well as retirement age.

Below is an example for someone who is currently 50 years old who has worked for ~35 years and earned all 4 work credits in those years.

Amount Lost?

$104,868: Full and late retirement.

Time Frame to Recover?

145 Months: Full and late retirement.

Spousal Benefits?

Early: benefit is permanently reduced based on the number of months up to their full retirement age.

Avizo Can Help

Within our Wealth Management services, we offer custom reports that show you and your spouse’s anticipated benefits based on work history and retirement timelines.

No matter how you cut it, Social Security guidelines and calculations are complex. Our CPAs have experience in helping clients determine the right decisions based on your overall retirement goals.

Tammy Busby, CPA

As our TACS Director, Tammy makes it a priority to understand how life choices can affect your financial situation. She is our go-to expert in tax strategy, tax law, PPP legislation, and Social Security.