In 2020, many businesses and nonprofits received federal grants and loans to help keep them afloat through the Covid-19 shut downs in the U.S. Though the money distributed is designed to be helpful in continuing business operations, it may come with the price tag of having to go through a “Single Audit”. Because the money was from the federal government, if your organization received more than $750,000 in federal funding from various stimulus bills, or other means, we should have a conversation about whether the federal funds will trigger one of these specialized audits.

Whether or not your organization has prior experience with undergoing Single Audits, the process can be complicated and risky if it’s not done correctly. Luckily for our clients, our firm has over 30 years of experience in Single Audit, with specialties in governmental and nonprofit auditing.

How Will I Know if I Will Need a Single Audit?

Of course, the safest course of action is to hire a professional (like Avizo) who can go through all the calculations of what you received, what you spent, and what is and isn’t eligible. But here are a few major points to keep in mind when determining whether you will qualify for a Single Audit:

- The criteria is based on the total grant/loan money you actually SPENT within a year. If you received $800,000 but spent $600,000 in 2020 and there remainder $200,000 in 2021, you do not meet the $750,000 threshold.

- The total is based on ALL grant/loan money, so if your entity receives an annual grant of $200,000 – even though you get it every year – you have to add it in with the Covid-related money.

- PPP money is NOT required to be added in for purposes of calculating whether you need a Single Audit. The SBA may separately audit PPP loans greater than $2 million, but your PPP money should not be added into your total for the Single Audit.

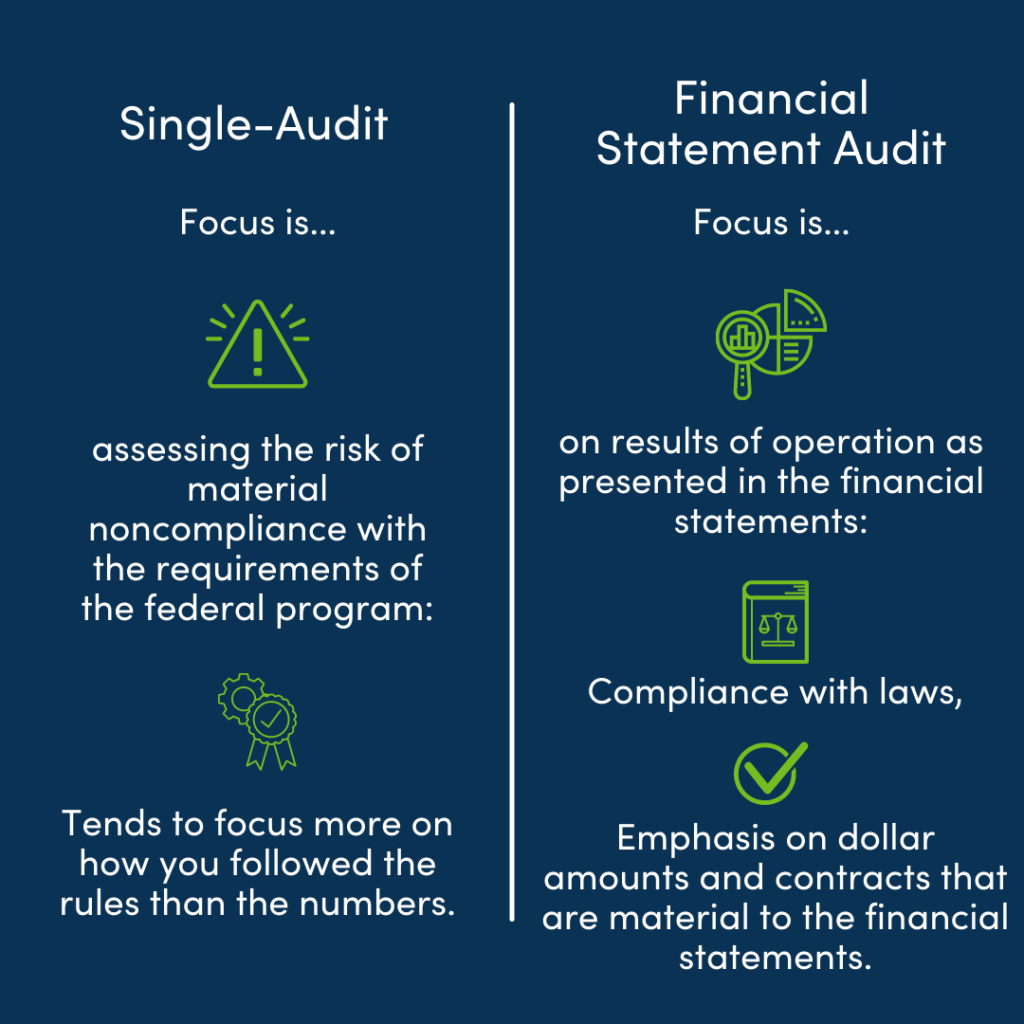

$750,000 is a pretty high threshold so many organizations who are familiar with “auditing” are thinking about Financial Statements audits. However, we expect MANY more organizations will need a Single Audit this year.

All of the following programs within the toggle boxes will have to be added into your calculations:

- Coronavirus Relief Fund

- Disaster Assistance Loans (EIDL)

- COVID-19 Telehealth Program

- Uninsured COVID Testing & Treatment

- Provider Relief Fund

- Grants for New & Expanded Services under the Health Center Program

- Rural Health Clinic Testing

- Coronavirus Emergency Supplemental Funding Program

- Coronavirus Relief Fund

- Education Stabilization Fund

Avizo Can Help!

Our team can help in several ways. First, we can help you determine if you will be required to participate in a Single Audit. This is an important step because it will give you the peace of mind knowing if you will need to go through the process at all. Our team can come on-site (or virtual if you still prefer) and gather the materials to determine if you meet the threshold.

Second, if it is determined you DO need a Single Audit, this is a service we offer. We can potentially DO the Single Audit for many clients, depending on whether there is a “conflict of interest”, which we will walk you through.

Don’t get caught off-guard with the Single Audit requirement. Our team is great at explaining every step, ensuring we do a thorough job in reporting, and keeping you updated with our progress. Contact our today by emailing [email protected] if you think this is a service you’re interested in hiring Avizo to help you through.