Sales tax nexus is the connection between a seller and a state that requires the seller to register then collect and remit sales tax in the state. It has traditionally been required if you have a physical presence in a state. Physical presence can range from, having a store, warehouse, office, to employees or sales reps in a state in which sales are made.

Now, because of the rise of online sales, along with a physical presence, states have now adopted Economic Nexus. Economic Nexus is established by having a certain amount of sales and/or a number of transactions sold in a state.

What IS Economic Nexus Sales Tax?

Well…. here’s the thing. There is no specific shared definition across the 50 states, which is what makes this topic complicated. Here is why this became a big deal.

South Dakota vs. Wayfair: In 2018, the Supreme Court ruled against traditional rules that required a physical presence as a necessary requirement to impose sales tax and collection requirements on a remote retailer.

Now, each state has the right to collect sales tax from online retailers (if they meet certain economic thresholds). Additionally, each state is allowed to set their own guidelines, start dates, thresholds, etc. And just one more wrinkle – the rules for determining nexus are also constantly changing. Below are some examples.

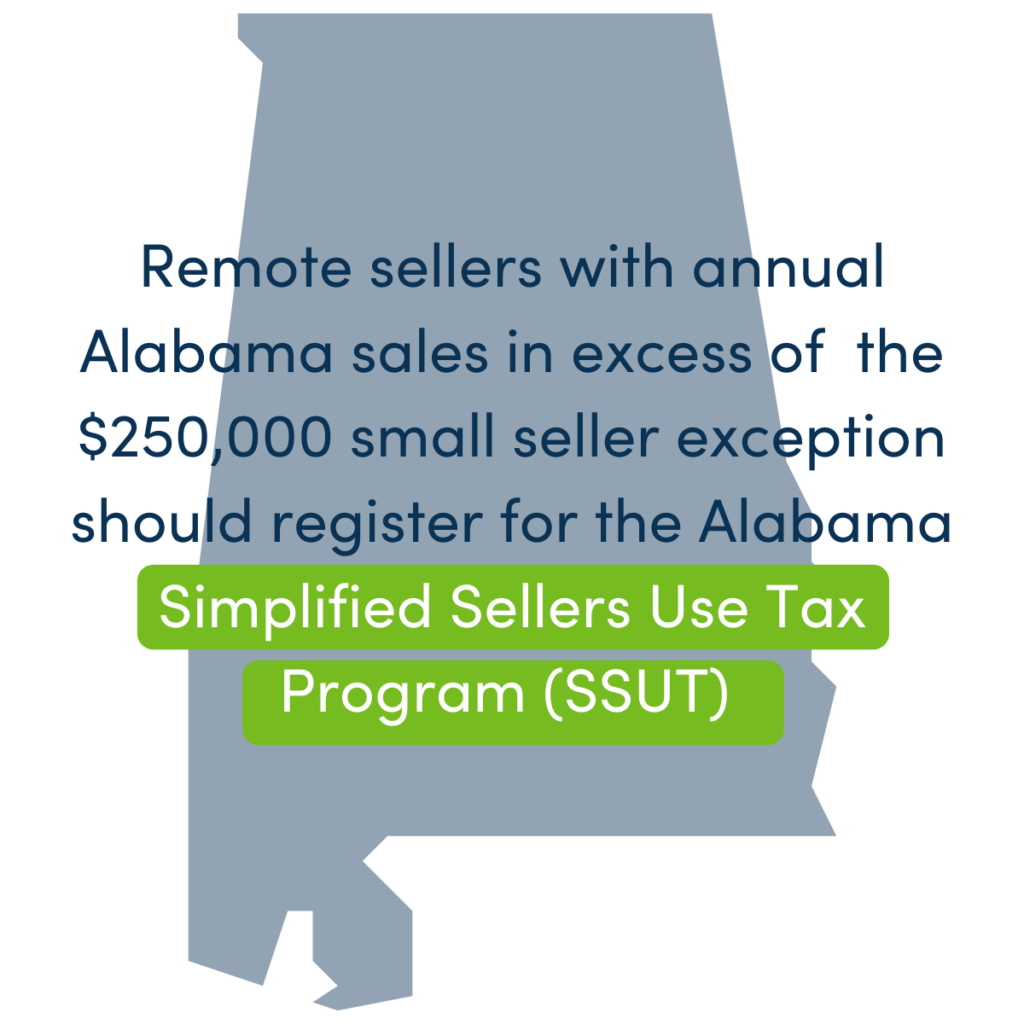

Alabama & Mississippi

Economic Nexus is triggered when you have $250,000+ in sales from all transactions in the previous calendar year.

Florida & Tennessee

Economic Nexus is triggered when you have $$100,000+ in sales from all transactions in prior 12 months.

Georgia & Louisiana

Economic Nexus is triggered when you have $100,000+ in sales OR 200 transactions from the previous or current calendar year.

Texas

Economic Nexus is triggered when you have $500,000+ in sales from all transactions in prior 12 months.

Varying Degrees of Economic Nexus

Each state has a website which outlines what their threshold is, when and how to register the business, and when to start collecting and remitting sales taxes. As a business owner, the best practice to ensure you’re following all guidelines is to check with a state, track sales according to their guidelines, and register and remit when required. Click this link to go to a state-by-state guide.

Here’s an overview of some of the “types” of nexus you may meet.

Currently active in 38 states, this is the connection between a vendor and another entity that may be related in some way or that performs certain work that can be attributed to the vendor to cause the vendor to have nexus in the taxing jurisdiction.

In effect in 20 states, this is established when an in-state marketing affiliate contracts with a remote seller for referrals. The seller must be making commission payments to the in-state resident for any orders that come about as a result of the click-through referral from the resident’s website.

Even if your business has not crossed economic nexus thresholds, some states have sales tax “Notice and Reporting Requirements” with significant penalties. Protect your business by registering for a sales tax permit if you’ve crossed the Notice and Reporting Requirements, but have not crossed the state’s economic nexus thresholds.

Click on the image to go to the Alabama Department of Revenue SSUT page.

As a business owner, looking at each state individually and also staying on top of constantly changing regulations and interpretations might be tedious, but as always, we are here to help you sift through the demanding legislation to make sure you’re covered.

Becky Jones, CB

Becky Jones is a member of our Client Accounting Services Team. She is an expert in preparing financials and helping clients get the most benefit from their cloud software.