It’s time to file taxes and this year, there’s an unwelcome surprise for some taxpayers regarding their Federal withholding on their W-2. Due to increased standard deductions enacted by the Tax Cuts and Jobs Act (TCJA) in 2017, a new W-4 form released in 2020, and the elimination of Covid-increased Child Tax Credit we’ve had the last few years, taxpayers are finding out that their withholding is too low, which is resulting in many taxpayers owing more to the IRS than they expected.

W-4 Form

But, allowances were eliminated on the redesigned Form W-4. In the past, the value of a withholding allowance was tied to the amount of the personal exemption.

TCJA

Individuals: from $6,500 to $12,000

Joint Filers: from $13,000 to $24,000

HOH: from $9,550 to $18,000

Covid-Related Buffers

For tax year 2021, the CTC increased from $2,000 to $3,600 for each qualifying child under age 6 and $3,000 for each qualifying child age 6 through 17.

W-4 Form

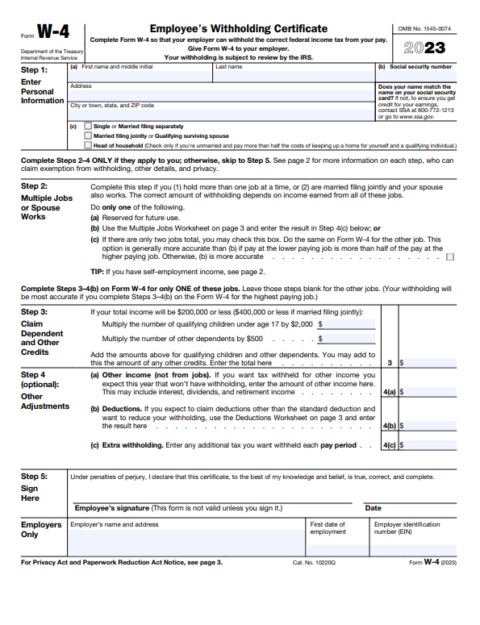

It seems the biggest part of the confusion is the redesigned Form W-4 and how taxpayers with children filled it out. The new W-4 is nothing like the 2019 and prior form when you would have entered “Married and 2” or “Single and 0” to determine your withholding. Instead, the new W-4 designed to reduce your income by the standard deduction – but this isn’t clearly explained on the form.

If you look at page 1 of the W-4, you’ll see in Section 1, you select your filing status and then in section 3, you enter the amounts for the number of dependents you have. In doing this, you are essentially choosing to receive your child tax credit through the year instead of waiting until you file to receive it as a refund or apply it to lower your tax liability.

We’re seeing that generally, taxpayers have filled it out correctly (meaning the way the IRS wants you to fill it out), but they don’t realize the difference it makes on their tax return refund.

While this does not put you in a favorable tax position when filing your returns, the actual dollar for dollar amount would have been the same. Instead of having withholdings on your tax return that reduces your taxable income or possibly created a refund, you received your money through the year in payroll.

What To Do in 2023?

The first thing I suggest is to run a calculation to make sure confirm your current W-2 withholding was calculated correctly based on what was entered on your W-4. The rate tables change every year, so be sure to check using the right one. Click here to download 2022 and click here to download 2023. If you learn that your withholding is “correct” but you aren’t happy about it, my recommendations for going forward are the following:

- Remove the dependent amounts from their W-4, or

- Enter an extra withholding amount on line 4c of the W-4. A good amount to enter is the tax liability you ended up owing on year’s return.

As always, clients who are concerned or have questions are welcome to call our office to have a conversation about their W-4 and what to say to an employee who gets a tax bill they didn’t expect.