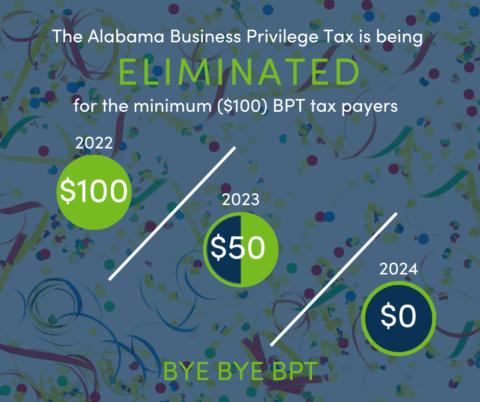

Business owners in Alabama will start seeing the phase-out of the minimum payments due for the Alabama Business Privilege tax when they file this year. Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

Alabama Business Privilege Tax

The Alabama Department of Revenue explains the Alabama Business Privilege Tax was created in 1999 and is levied for the privilege of being organized under the laws of Alabama or doing business in Alabama.

Traditionally, the BPT amount due is calculated based on the entity’s federal taxable income apportioned to Alabama. The rates range from $0.25 to $1.75 for each $1,000 of net worth in Alabama with a minimum business privilege tax set at $100 and the maximum amount capped at $15,000. The $100 minimum was required for every year that an entity legally existed – even if the business was not actively conducting business or had no net worth.

Under new law, if you are one of the 230,000 entities who pay the minimum fee of $100, this year you will pay $50 and for 2024 and beyond, the BPT is eliminated. However, if your entity owes more than the minimum of $100, your BPT will continue to be calculated and due as it has been in the past.

If you have any question about the AL-BPT your entity may owe, please contact your Avizo consultant.

Chris VanArsdale

Chris is a Strategic Analyst who maintains expertise in litigation support, international taxation, and complex entity and fiduciary taxation services.