In today’s world of “side hustles” and finding ways to make a little money outside of a full-time job, the IRS wants to make sure they are receiving their share of money circulated. Because of this, tax laws change as the IRS adapts to recognizing new incomes streams. This article will break down the current regulations for two of the most common “extra income” options – hobbies and gig economy work.

Making Money from a Hobby

A hobby is generally something you do for fun – such as painting, embroidery, soap-making, or a even creating content for a blog/YouTube channel. It could also be something that you happen to have a special skill or certification in – such as pet/baby sitting, teaching a foreign language, or health coaching. Even if your primary purpose for doing a hobby is for fun, if you make money from it, you need to report the income on your tax return. Current tax law requires you to report your income, but it does not allow you to deduct any hobby-related expenses.

Hobby versus Business

Due to regulations in the Tax Cuts and Jobs Act, beginning in 2018, taxpayers are no longer allowed to deduct hobby expenses to offset the income generated from them. The only way to deduct hobby expenses is to turn it into a business. However, the IRS has strict guidelines about hobby-to-business rules and requires that you have a profitable hobby.

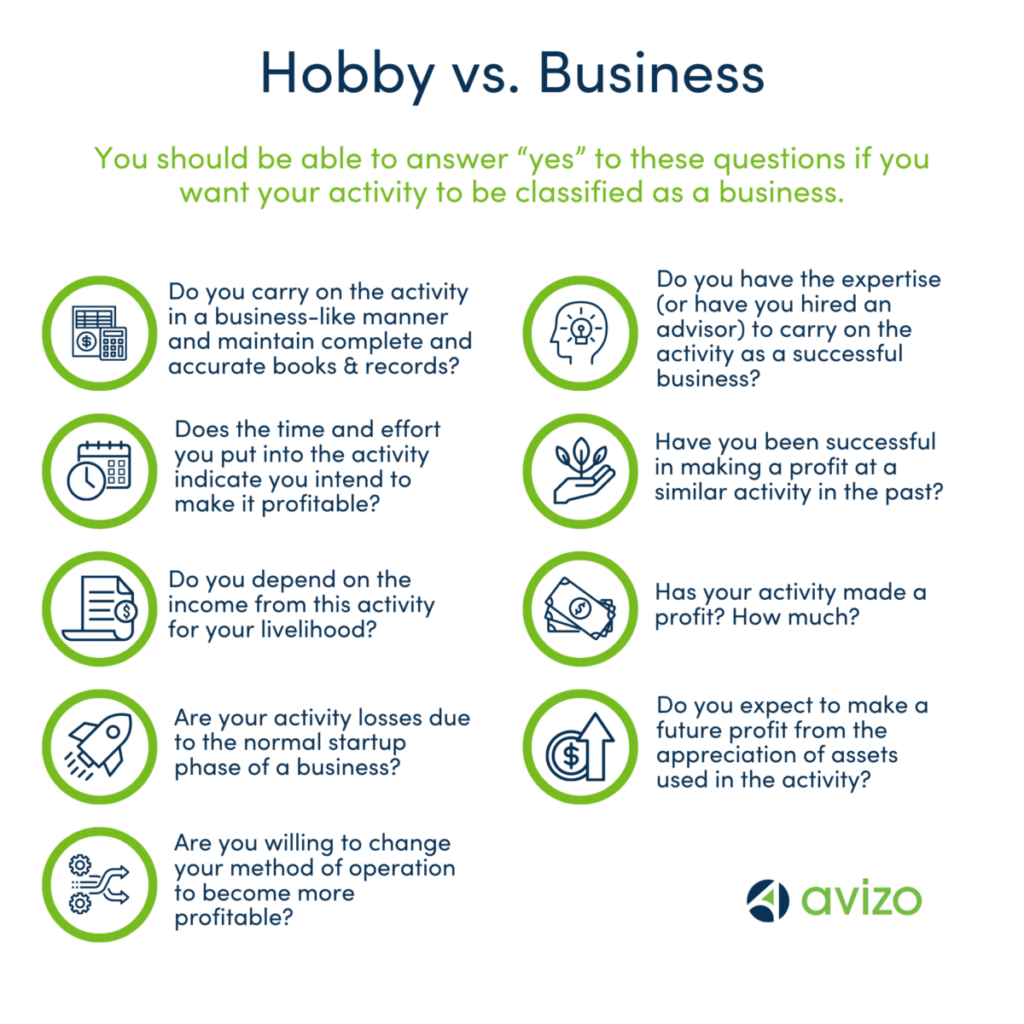

You should not take something you enjoy doing and create a business simply for the tax benefits. In fact, there could be major penalties for doing so. The IRS has 9 guidelines to follow to help you determine if you can categorize your hobby as a business. These are listed as questions in our Hobby vs. Business image. You should be able to answer “yes” to these questions if you want to turn your hobby into a business.

If your hobby is simply just a hobby with no business-intentions and you’ve made money from it, you can manually track your income using something as simple as Excel to record the date and amount of money collected.

Making Money from the Gig Economy

The “gig economy” is a term to describe when people earn income providing on-demand work, services, or goods on a contractual basis rather than being hired by a company. A gig economy worker has no specific schedule and gets paid only when they choose to provide the service to others. Some common gig economy side hustles include driving for rideshare companies like Uber and Lyft, shopping for others through services like InstaCart and Shipt, and delivering restaurant food through DoorDash and Postmates.

Gig Economy Income & Expenses

Unlike a hobby, you can deduct many work-related expenses to offset the income earned from gig economy activities. Even if you haven’t turned the gig economy work into a business, the IRS expect you to make estimated tax payments through the year and have thorough details on income and expenses, including receipts. Visit the IRS page “Manage Taxes for your Gig Work” to see learn the details.

For income, a 1099-K is the form sent to gig economy workers. A 1099-K is not required unless the taxpayer earns $600 or more. Still, the IRS is very clear that you must report income earned from the gig economy on a tax return, even if the income is:

- From part-time, temporary or side work.

- Not reported on an information return form — like a Form 1099-K, 1099-MISC, 1099-NEC, W-2 or other income statement.

- Paid in any form, including cash, property, goods, or virtual currency.

Avizo Advice

If you are hoping to turn a hobby into a business or if you are generating money from a hobby or from gig economy work, it’s important to maintain great records and speak to a business consultant. Our team can provide tax and financial advice along with software options to make tracking income and expenses simple. We enjoy working with business owners to help create a financial and strategic plan to reach your goals. Set up a meeting if you would like to learn more.

Chris VanArsdale

Chris is a Strategic Analyst who maintains expertise in litigation support, international taxation, and complex entity and fiduciary taxation services.