When you hear the words “audit” and “auditor”, what are your initial thoughts? Many people get a negative feeling because we often hear “audit” in relation to something the IRS does as a way to catch mistakes on tax returns. Being an auditor, I can say the audit work we perform at a public accounting firm is NOT the same as an Internal Revenue Service audit. The work we do is meant to help your company both by providing a sound check-up on finances and by detecting any possible issues you may be unknowingly experiencing.

IRS Audit vs. Financial Statement Audit

An IRS audit (the one commonly imagined when you think of the word “audit”) is a review or examination of an organization’s or individual’s financial information. The goal is to ensure information was reported correctly according to tax laws and to verify the amount of tax paid/owed is correct. These audits are usually chosen randomly or based on a screening that considers “norms” of similar tax returns and makes audit selections from those outside of the norms. An IRS audit is not optional for those selected and requires documentation to essentially “prove” the income, expenses, and deductions listed within the filed returns.

On the other hand, an external financial audit is the process of performing procedures to obtain audit evidence related to the amounts and disclosures in an organization’s financial statements in order to provide an independent opinion that management has fairly presented the financial statements.

Financial statement audits are performed are on an entity – not on an individual. During a financial statement audit, an independent 3rd party (such as Avizo’s assurance team) evaluates the internal records related to the amounts and disclosures stated in the organization’s financial statements along with an organization’s financial position. It is performed with a materiality threshold, which means transactions are considered based on their perceived risk. From this, we express an opinion with respect to the financial statements and whether they comply with the accounting practices the company uses, which gives your organization confidence that the financials are fairly stated, in all material respects.

What is the Purpose of an Audit?

There are a few reasons an organization might need to get an audit. For some, an audit is required by an outside party, such as a lender, grantor, or government/regulations. There are also some organizations (for instance a large nonprofit) that require an audit in their by-laws, organizational documents, or by a National group. Many organizations will also get an audit in the years when they organize a capital campaign so they can show donors that funds are being used correctly. Finally, there are instances when the government requires a “single audit”, which is when an organization spends $750,000 or more of Federal funding in one fiscal year.

No matter the scenario for why an organization gets an audit, the purpose of is to provide independent assurance that management has fairly presented the financial statements, in all material respects. An audit adds credibility to an organization’s financial position and business performance, which can give the shareholders, investors, banks, customers, employees, and other stakeholders comfort that the numbers they use for decision making are presented fairly.

Help secure external financing from lenders and donors

Help your organization

qualify for grants

Provide assurance to the board of directors and other stakeholders

Demonstrate transparency

Rather than come into an organization with a big red pen to tell you all that you may be doing incorrectly, our goal is to help our clients as they grow their organizations. We partner with our clients to make recommendations for improvements that contribute to efficiency and accuracy in financial reporting. If you’d like to know more about our assurance services, please check out the information on our Assurance Services page.

Misconceptions of Audits

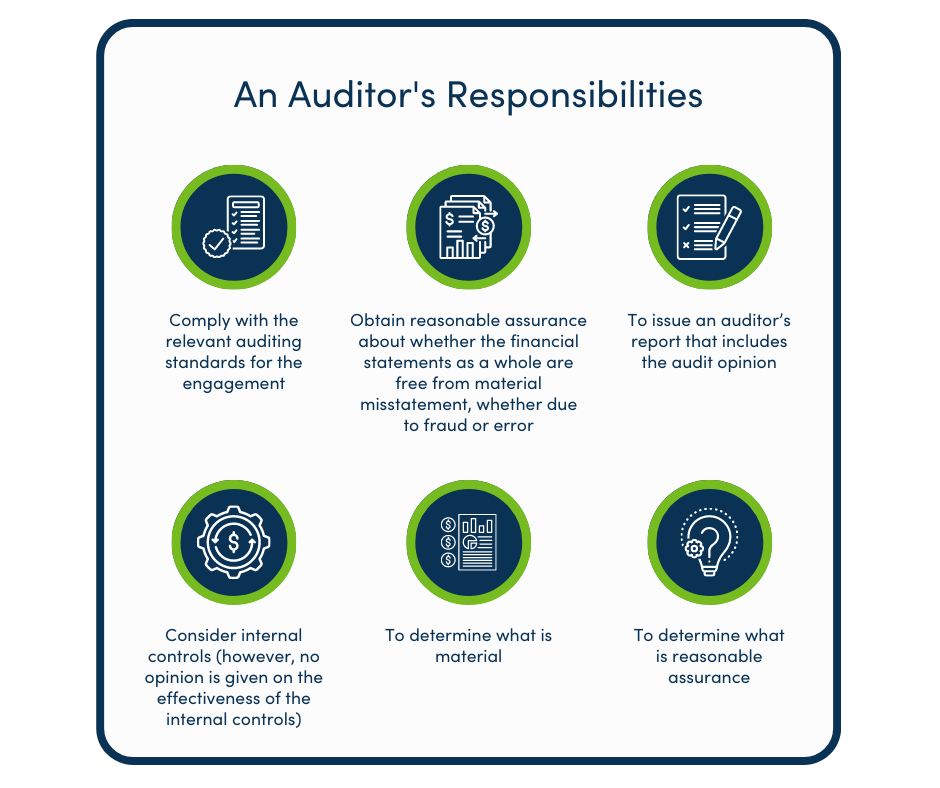

We’ve already debunked the idea that an audit performed by a certified public accounting firm is similar to a tax audit, but there are a few other common misconceptions we want to clear up. Click into each of these sections to learn more about what an auditor does/doesn’t do during a financial statement audit:

If fraud is suspected during the course of an audit, we will report it. However, when we take on an audit, we are not specifically testing for fraud. If you want test for fraud, you would need to engage our firm to conduct a unique service called a Forensic Audit/Examination:

- Designed to find any illegal financial activity

- Uses different types of investigative techniques

- Gathers evidence to be used in a civil or criminal court of law

Auditors do not take responsibility for the financial statements on which they form an opinion. The audit report belongs to the auditors. The financial statements belong to the entity.

This would negate independence. Auditors are not part of management and cannot act as management or make management decisions.

An audit performed by our firm is the highest level of assurance your organization can receive. However, not all organizations NEED to get an audit. There are many other assurance services our firm can perform that are less in scope than an audit, which you can learn about on this blog (insert link). If you are interested in learning more about our audit process or any of our assurance services, just reach out – we are always available to help organizations learn and understand which services will be the most beneficial for their situation.