In June of 2023, new legislation passed in the state of Alabama to temporarily eliminate the 5% Alabama state tax on overtime pay for full-time employees. You can read about the initial measures in this blog, but now that some time has passed, the Alabama Department of Revenue (ADOR) has released their guidelines on what business owners will need to do. Here’s an overview:

Employees must be full-time.

Employees must be paid hourly wage (not salary).

The exemption begins on 1/1/24 and currently expires on 6/30/25.

There will be two reports due to ADOR.

Alabama Overtime Reporting Guidelines

Employers are required to report total aggregate amount of overtime paid as well as the total number of employees who received overtime pay. There are two reports you are required to submit to ADOR.

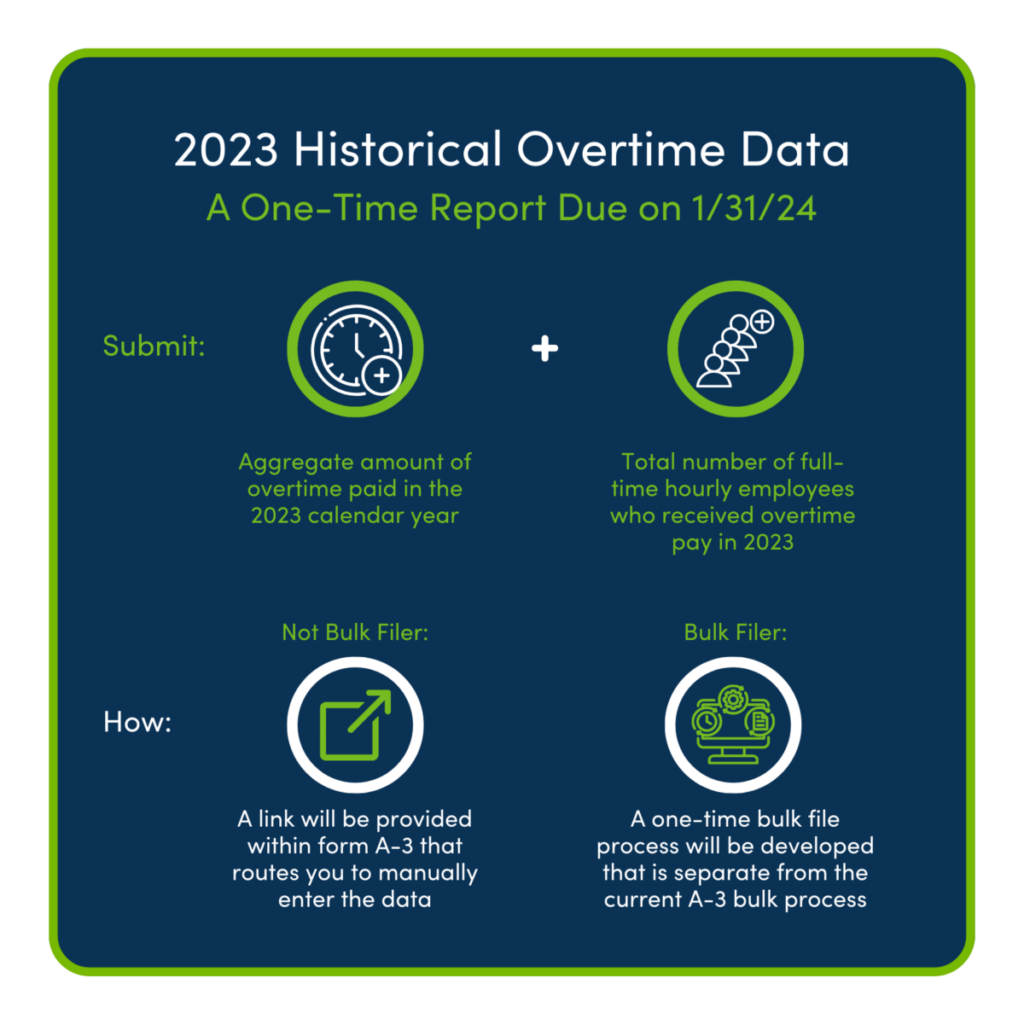

2023 Information

Even though 2023 overtime was/is still being taxed, you will be required to submit a one-time report showing the aggregate amount of overtime paid in 2023. The report must also include the number of full-time hourly employees who received the pay.

Due Date: January 31, 2024

Not Bulk Filers: A link will be provided within form A-3 that routes you to manually enter the data. (This is most small business owners.)

Bulk Filers: A one-time bulk file process will be developed that is separate from the current A-3 bulk process.

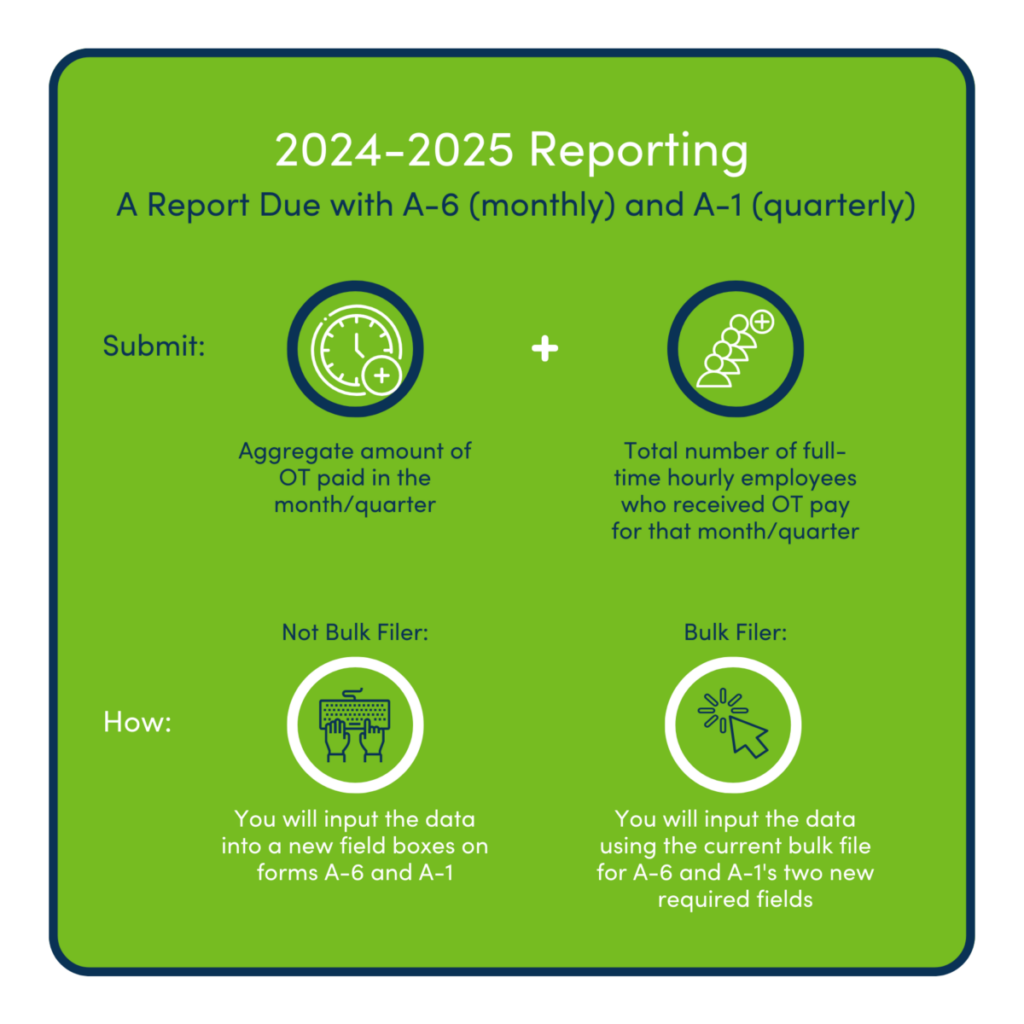

2024-2025 Information

A monthly/quarterly report of the data will be due starting 1/1/2024. At the end of the year, the monthly/quarterly reports will need to be tied out to the employer’s reporting of withholding tax.

Due: With A-6 (monthly) and A-1 (quarterly)

Not Bulk Filers: You will input the data into a new field boxes on forms A-6 and A-1.

Bulk Filers: You will input the data using the current bulk file for A-6 and A-1’s two new required fields.

Additional FAQs

No More Paper Filers

Are you a paper filer? Register for MAT today:

The Employee is an Alabama Resident But Works Outside of the State

The Employee is not an Alabama Resident

Although this change will require a bit of extra work to gather the data requested, the Alabama Department of Revenue’s reporting procedure appears to be simple additions to the current forms. As an employer, if you feel payroll reporting is becoming burdensome, please reach out. Our experts have software and services options that can help you.

Crissy Bonifay

Crissy is Avizo’s payroll pro. Having been with the firm for 25 years, she’s developed many talents, and we rely on her to be our go-to guide for payroll deadlines, processes, and software.