Now that remote work options are more common and people are choosing to live and work in different locations, some states (including Alabama) are reconsidering how to collect taxes on wages earned. Alabama’s historical policy (which is the same in almost all states) was that a nonresident’s wages are taxed to where the service is physically performed. However, an Alabama Tax Tribunal decision earlier this year directly conflicts with this long-standing policy of residency and taxes. The ruling decided an individual with an Alabama-based employer who moved to Idaho still owed Alabama taxes on the wages he earned while working in Idaho. This could result in major tax implications for other employees who live in a different state from where they work.

Alabama’s New Remote Employee Tax Ruling

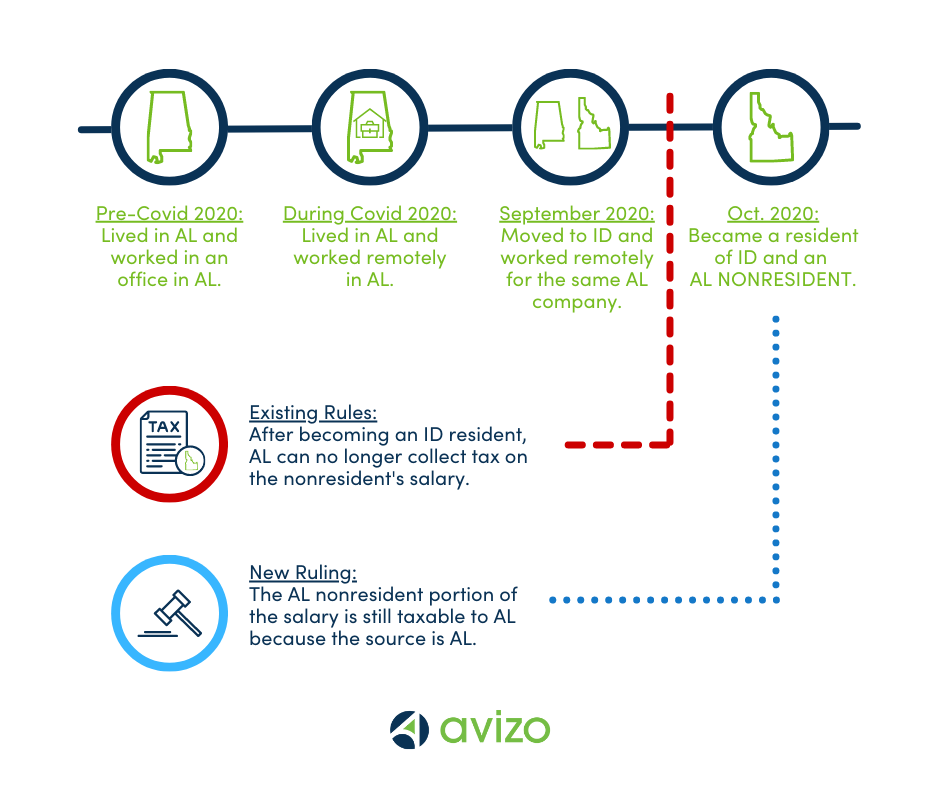

In the tribunal case that has upended double taxation rules, the taxpayer worked for an organization in Alabama. Because of Covid, he began working remotely in the same role for the organization while living in Alabama in early 2020. He then relocated to Idaho in September 2020 and continued to work for his employer in Alabama from the date of his move in 2020 until October 2021. During this time, he gave up his apartment in Alabama, had no property in Alabama, and voted in the 2020 Idaho election. However, he kept his Alabama driver’s license because it had not expired. When he received his 2020 W-2 from his Alabama employer, it showed all wages were reported to the state of Alabama.

On his tax return, the individual only reported wages to Alabama from January-September for the dates he lived in the state (which was considered the correct way to report this income).

Because the W-2 showed the entire year of income to Alabama and not only the months he lived in Alabama, the Alabama Department of Revenue sent a notice requesting tax payment on wages for the full year. He appealed the decision, which resulted in the new Tribunal decision.

Ultimately, the Tribunal agreed this individual established a new domicile in Idaho, even though he hadn’t updated his driver’s license. Because of all the other steps he took to establish residency in the state of Idaho, he was considered an Alabama nonresident.

However, even though he may have been an Idaho resident, the tribunal ruled his entire 2020 salary was taxable to the state of Alabama because of its source (meaning the organization who paid him is located and operates in Alabama). They determined the individual maintained regular and legal employment with a business located in Alabama – and that the availability of remote work means his physical presence in Alabama is no longer needed for him to maintain employment in the state. Since he kept the same job and reported to the same managers, they decided Alabama is owed tax on his salary, even the wages earned after he became a resident of Idaho.

Current Alabama Nonresident Taxes

We don’t know yet how this will work in the long-run. Will employees who live and work in two different locations be double-taxed? If the employment or residence is in Alabama, it appears so. Here are the current rules on the Alabama Department of Revenue’s website.

If you are not a resident of the state of Alabama, but earned income from Alabama sources (including wages, property rented, or business transacted), that income is taxable and the individual should file a Nonresident Individual Income Tax Return, form 40NR for each qualifying year.

If you are a resident who lives in the state of Alabama, and you work in another state or country, you are considered domiciled within Alabama and state taxes apply on all income, whether it was earned in Alabama or not. Alabama resident file a Resident Individual Income Tax Return, Form 40 or 40A each applicable year.

Steps to Become an Alabama Non-Resident

You can read more about remote employees and taxes on this blog, but one major thing to do if you move out of the state of Alabama and will continue to work remotely for an Alabama-based organization, is to “establish a new domicile”. You need to be able to show permanent residency in your new location to avoid being taxed fully in both states. States will conduct an audit on former residents to determine whether or not they are legally still considered a resident. The more you can provide your domicile has changed, the less likely you’ll get taxed fully in your old state. (Or at least that is the the historical rule.)

The Alabama Department of Revenue (ADOR) suggests you complete the following actions to establish a new domicile:

Close bank accounts in your old state.

Buy or rent a home in your new state.

Update your mailing address for all bills.

Get your driver’s license/update vehicle tag & registration in the new state.

Register to vote in the new state.

Ask your employer to update taxable employee benefits, stipends, and wages to the new state/location.

It will be important for employers and employees alike to pay attention to state laws as they update rules surrounding remote work and taxes. This case with Alabama is certainly a surprising change from past regulation. If you’re unsure about how to withhold taxes for your remote employees, be sure to work with a payroll provider and accountant who can help maintain your compliance.

Taylor Clinkenbeard, CPA

Taylor is a Strategic Analyst in our tax and client accounting services teams. She has developed specific expertise in software, accounting processes, and tax laws to serve our clients.