One of the remaining effects from Covid-19 is that more and more employees are seeking positions that include flexible working arrangements as part of their employment benefits package. While remote employment can give employers a wider range of candidates and boost employee morale, if your employee(s) live outside of the state where your organization is located, you are responsible for withholding state and sales tax accordingly.

During the pandemic, many states did not enforce taxation rules because remote work was expected to be temporary. However, now that hybrid and remote work is becoming part of the new business model, states want their cut of the tax pie. By 2022, all states reverted to their pre-pandemic withholding requirements, which could result in a surprising tax bill for both employee and employer.

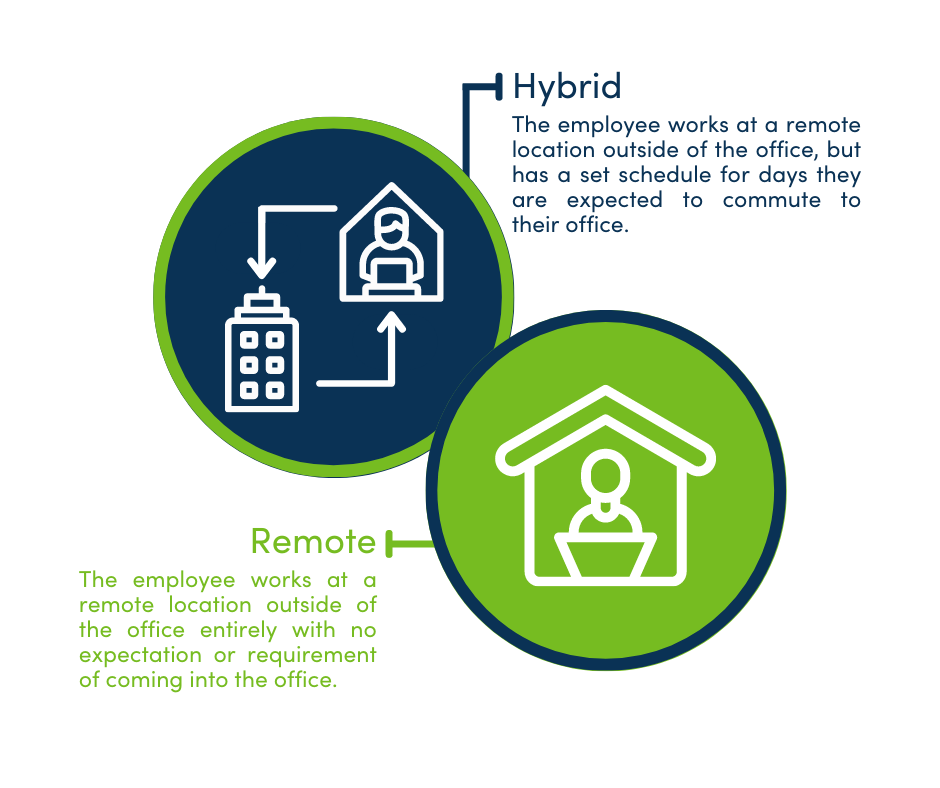

Remote vs. Hybrid Employee

Generally, there are two types of employees who work outside of the office: hybrid and remote. A “hybrid position” means the employee may do the bulk of their work outside of the office, but he or she will be expected to commute to their office part of the time – and you will set the expectation – whether once a week or once a year, it’s up to you. Alternatively, a position that is posted as “remote” allows the employee to complete all tasks for their job from a remote location, without ever commuting to an office.

Either option gives the employee more range on where they can live – and some may choose to live in a different city or state from where your organization is located.

Overview of Hybrid and Remote Employee Taxes

Federal

States with

No Income Tax

States with

Income Tax

Federal: At the Federal level, no matter where the employee works, the employer is responsible for withholding federal income tax as well as Federal Insurance Contribution Act (FICA) tax which covers Medicare and Social Security contributions. FICA taxes are set percentages in accordance with federal laws while the Federal tax withheld will be based on the employee’s salary and how they fill out their W-4.

State: The state and local taxes can vary widely. Some states charge a fixed rate on all income, some have tax brackets, some charge no income tax at all and might have local taxes instead. When it comes down to where to pay state tax, the general rule is that you pay the tax to where an employee is physically located. You will have to follow that state’s wage and hour laws, overtime rules, minimum wage rates, and their guidelines for permitted deductions. Any garnishments for child support and creditors will also follow the employee’s state rules.

If you’re going to offer flexible work arrangements, it’s important to work with a payroll and tax advisor who can help ensure your payroll complies with different state and local regulations.

State Tax Rules for Out-of-State Employees

As an employer, you’ll be expected to withhold unemployment withholdings from the state where the employee lives – not to the state where your organization is located. If an employee lives in a different state, we recommend that you talk to your accountant and/or payroll provider to ensure you’re withholding taxes correctly. Here is a quick overview of the differing rules for where an employee lives:

If your employee lives in a different city, but in the same state as your organization, the same rules apply as they do to traditional in-office employees. You will withhold state income taxes if applicable* and pay any required unemployment and other payroll taxes the same as your in-office employees. If you live in a state that has different local taxes in different areas, you will need to withhold local taxes as applicable.

The employee could be subject to tax liabilities in both the state where they live and the state where your organization is located, which means you will need to withhold Federal taxes as well as both states. Generally, an employee will pay non-resident income taxes to the state where the organization is located and resident income taxes to the state where they live. This also means they will be required to file tax returns for both states. Some states have reciprocal agreements allowing the employee to request an exemption from the double taxation, but Alabama does not have this in place.

If you have (or want to have) remote employees, you can contact the State Labor Offices to make sure you understand the tax implications. Contact information for each state can be found on the Department of Labor website.

Will Remote Work Work for You?

Your specific industry and organizational culture will be the primary way to determine if off-site work is possible for your employees, but we are seeing more and more people in the job market who want this option. If you want to include this benefit, it’s important to know how it affects both your payroll processing and the employee’s taxes.

Finally, some states – including Alabama – are now passing new laws regarding remote work, so be sure to follow our social media pages to learn about changes as they happen, and contact us or your payroll provider with any questions.

Taylor Clinkenbeard, CPA

Taylor is a Strategic Analyst in our tax and client accounting services teams. She has developed specific expertise in software, accounting processes, and tax laws to serve our clients.