There is a change on the horizon for Employee Benefit Plans (EBP) and their audit requirements. In the past, an EBP needed an audit if they had 100 or more employees who were ELIGIBLE to participate – even if only a few were actually active in the plan. Starting next year, the calculation for number of participants will NOT include inactive but eligible employees. This means if your company falls below the 100-person threshold, you will no longer need to get an annual audit.

Expiring Employee Benefit Plan Audit Rule

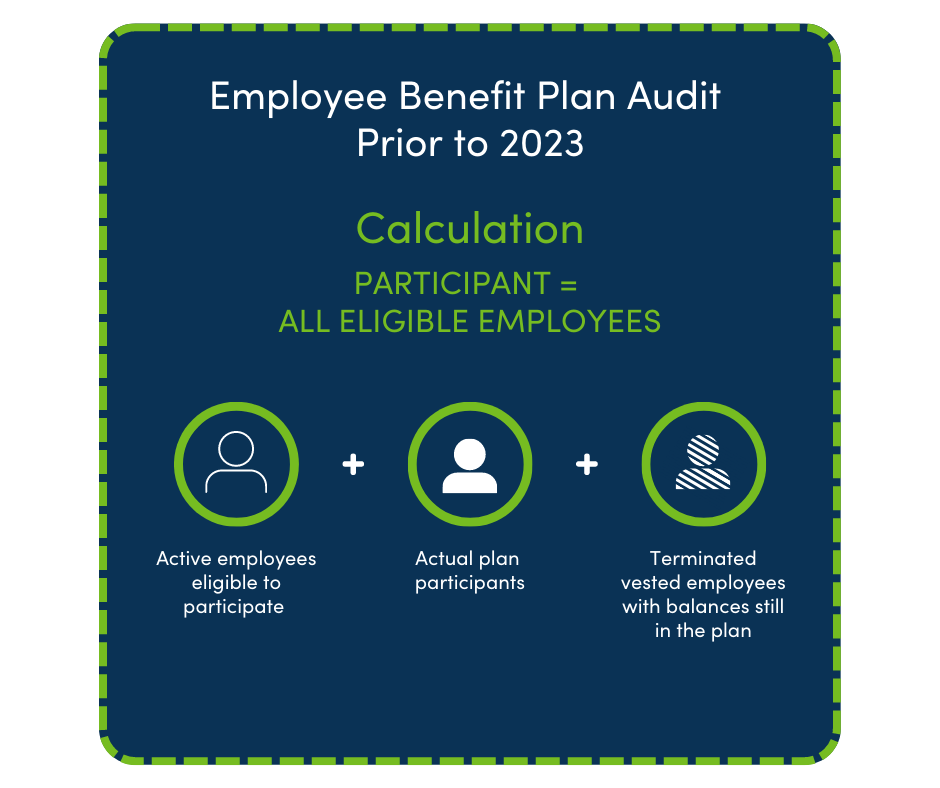

The original rule is that an employee benefit plan audit was required for all benefit plans with over 100 participants at the beginning of the year. The calculation to determine how many participants included counting active and eligible employees and terminated vested employees with balances still in the plan. Using this calculation method, plans needed to include ALL employees that were currently employed and eligible for the plan, whether or not they were actively participating in the plan and receiving benefits.

Due to this broad calcuation, some Plans required an audit even though active participants were significantly less than 100.

Employee Benefit Plan Audit Rule for 2023 and Beyond

Beginning in 2023, only participants (active and terminated) with account balances are included in the calculation for the number of participants at the beginning of the plan year. Employees who are active and eligible to participate but have never contributed to the plan and/or received employer compensations will no longer be counted.

As a result, some plans will now be able to claim the small plan audit exemption for plan years beginning in 2023, even if they previously needed to be audited.

The EBP 80-120 Rule

In an attempt to make the audit requirement less burdensome on employers whose employee count varies slightly above or below 100, the 80 – 120 rule was created. This allows plans with between 80 and 120 active participants to elect whether to file as a small or large plan if they meet certain requirements.

- Small plan: Under this rule, benefit plans can continue to file as small plans if active participants at the beginning of the plan year are less than 120 and the plan filed as a small plan in the previous year. This can be a huge benefit to plans whose active participants fluctuate.

- Large plan: However, once a plan reaches 120 participants, it must be reported as a large plan an have an annual audit until active participants goes below 100.

With 80 or less active employees in the plan, you may continue to file as a small plan and avoid the independent audit.

If you start the year with less than 120 active participants AND you filed as a small plan in the previous year, you may continue to elect to file as a small plan.

When you report at least 121 active participants, you must file as a large plan. If you file as a large plan after employing the 80-120 exception, you must continue to file as a “large” plan – even if your participant count drops below 120 – as long as you have at least 100 active participants in your plan.

Independent Audit Services

Since these rules are complex, if an employer is unsure whether they are required to have an independent audit, please reach out to our assurance team. It’s better to get ahead of it and make sure you are not surprised by the need for an audit right before the filing deadline. If you have an employee benefit plan that now requires an audit, our team has the expertise and resources to help you meet your audit requirement as well as improve your employee benefit plan.

Kirsten Robertson

A Strategic Analyst on our assurance team, Kirsten maintains expertise to provide auditing services with a specialization in Avizo’s governmental and construction-based niches. She is one of the primary leads on our in-field audits and completes training for all members of the firm before they visit clients offices.