In order to comply with tax legislation changes under the One Big Beautiful Bill Act (OBBBA) that was signed into law on July 4, 2025, the IRS has released a draft of the 2026 W-2 Form to capture overtime and tip income. Please do not use this for any filings as this is only a draft, and it is not designed to be used for 2025 data.

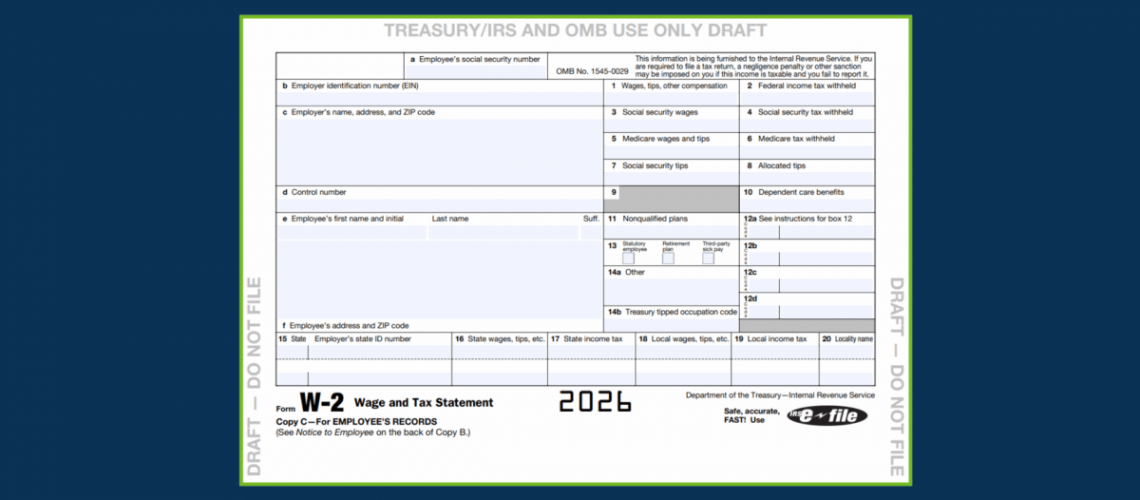

2026 W-2 Draft

In the IRS 2026 W-2 draft, the boxes for number 12 will capture income from tips and overtime and the 14b box will capture qualifying industry code for tip income.

These draft forms are for 2026, but the OBBBA passed the provisions to apply for this year as well (2025). The IRS announced they are not planning to update W-2 or 1099 Forms or withholding tables for 2025, so taxpayers, employers, and accountants will have to develop a system for tracking and reporting this information with sufficient documentation to show the amount of overtime and tip income reported on 2025 tax returns. We hope for more guidance, but urge employers to develop a system with reports if overtime pay and tips are not currently being tracked.

How to Report Tip and OT on the 2026 W-2

In the draft, Boxes 12 a-d will be the place to code and capture the income from tips and overtime. New codes have been added to address updates to the tax code.

- TP—Total amount of qualified tips. Use this amount in determining the deduction for qualified tips on Sch. 1-A (Form 1040).

- TT—Total amount of qualified overtime compensation. Use this amount in determining the deduction for qualified overtime compensation on Sch. 1-A (Form 1040).

For tips, 14b will also need input. 14b is now labeled “Treasury tipped occupation code” which is where the industry code will be entered.

The No Tax on Tips legislation strictly defines both what is considered a tip and that only those working in “customarily tipped industries” will be included, so the IRS will also have to produce an official list of qualifying occupations that are eligible to claim this credit. They have been asked to release this list by October 2, 2025.

We are also still waiting to hear more definition on the No Tax on Overtime provision. There is an assumption that the exemption only applies to the “half” of the time and a half pay. This would mean if your rate is $20/hour then your overtime pay at time-and-a-half is $30. The assumption is that only the extra $10 is exempt from Federal tax. This has not been clarified by the IRS, but it will require extra calculations for overtime tracking if this is the case.

2025 W-2 and 1099 Reporting

The Tip Deduction is up to $25,000 per year and the maximum annual deduction for overtime pay is $12,500 for single filers and $25,000 for joint filers, both phasing out for single taxpayers earning over $150,000 and married filing joint earning $300,000. These are substantial deduction amounts that will impact a significant number of filers. Since the IRS is not providing a form for 2025, we recommend business owners implement a tracking process now instead of waiting until W-2s and 1099 filing deadlines are approaching. Contact us if you want to review your processes and make sure you aren’t scrambling in Janurary.

Taylor Clinkenbeard, CPA

Taylor is a Manager in our tax and client accounting services teams. She has developed specific expertise in software, accounting processes, and tax laws to serve our clients.