Applying a Research and Development (R&D) Tax Credit on your tax return can deliver real financial value to your business. Many business owners assume that only large organizations can leverage this dollar-for-dollar tax incentive, but the R&D credit can be used in an organization of any size.

In fact, many companies are surprised to learn that they qualify for the R&D Credit—even those outside of traditional “tech” or “lab” industries. If your business is improving processes, developing new products, or innovating in any way, you may be eligible for substantial tax savings. Although many more industries can apply for the R&D credit, these are our specialties – click the icons below to learn more specifics.

What Is the R&D Credit?

Originally enacted in 1981, the R&D Tax Credit is a federal incentive (and in many cases, also a state-level incentive) designed to encourage innovation by rewarding businesses that invest in research and development activities. The Protecting Americans from Tax Hikes (PATH) Act in 2015 made this a permanent tax credit and extended the benefits to provide opportunities for startup companies to use the credit. The credit enables businesses of all sizes to reduce their federal income tax by claiming qualified research expenses. These expenses typically include costs associated with developing or improving products, processes, or software, and must be tied to research activities that involve experimentation and technical uncertainty.

Businesses may claim the credit retroactively for the past three to four years, offering a valuable opportunity to increase cash flow and lower their overall tax burden. Companies within their first 5 years of operation and earning less than $5 million in gross receipts—can apply the credit against quarterly payroll taxes, providing up to $250,000 in annual relief.

To claim the R&D Tax Credit, businesses must identify and categorize all qualified activities and expenditures, then file IRS Form 6765 as part of their annual tax return. The process can be complex, but with the right guidance, it becomes a strategic financial tool.Avizo can help determine whether your company’s activities meet the qualification criteria, assist with the necessary documentation, and support you in filing both federal and applicable state credits. With our expert assistance, your organization can unlock meaningful tax savings and reinvest more capital into continued innovation.

Qualifying Research Activities

- Development or improvement of products, software, or processes

- Investment in prototypes, testing, or new formulations

- Employment of engineers, designers, scientists, or technical experts

- Solving technical challenges that require experimentation or problem-solving

- Development of conceptual designs and defining requirements and specifications for new or improved product

- Building and testing prototypes

- Development of production processes and equipment

- Evaluation and testing of new materials for product development

- Design and development of new or improved software applications

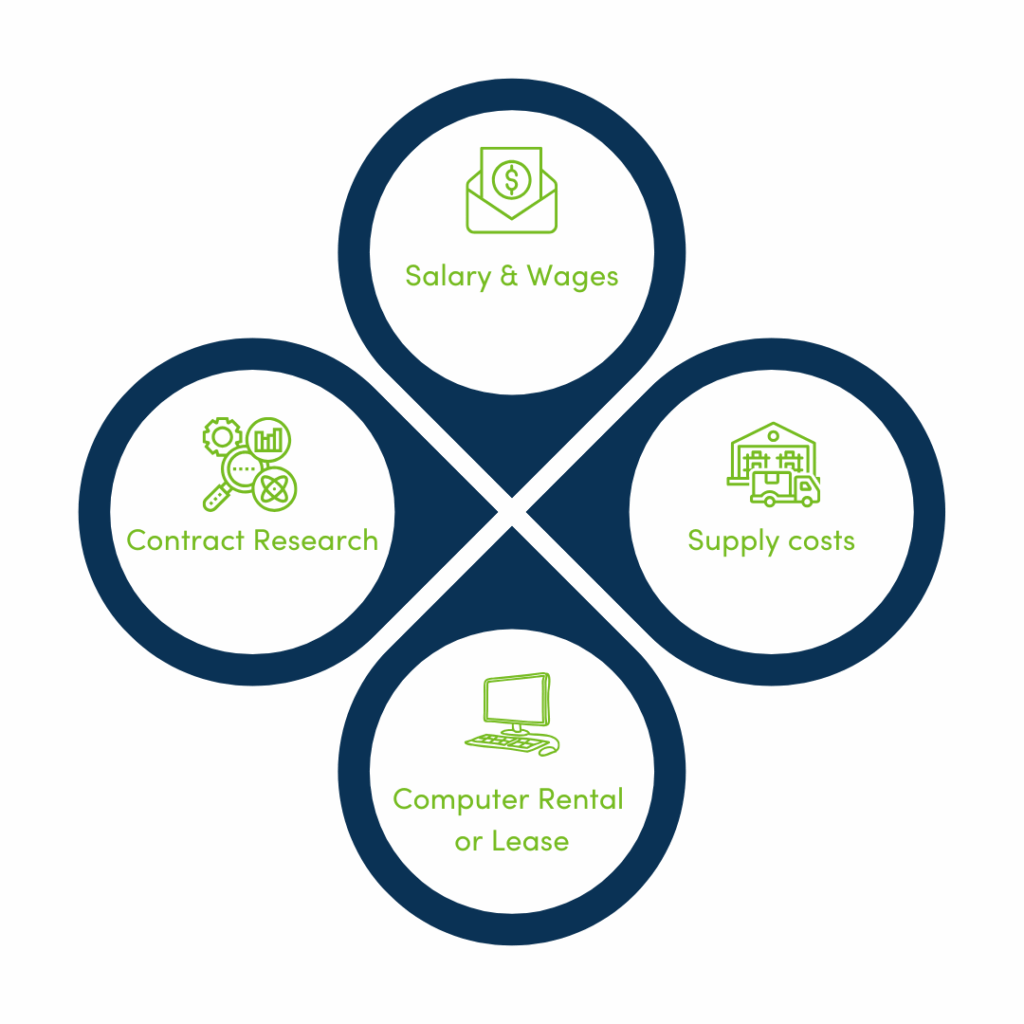

Qualifying Expenditures for the R&D Tax Credit

- Salary and wages:

- Employees that perform direct research.

- Employees that directly supervise research.

- Employees that directly support research, such as the time an assistant dedicates to taking notes and accumulating data on the qualified project.

- Supply costs: for prototypes and testing materials.

- Computer rental or lease: an expense often needed with software development.

- Contract research: 65% of the cost of a nonemployee researcher can be included.

The Four Part Test

The four-part test requires a successful applicant to have thorough documentation as proof of having met these four criteria: having a permitted purpose, technological uncertainty, the process of experimentation, and being technological in nature.

Permitted Purpose

Permitted Purpose

Technical Uncertainty

Technical Uncertainty

Process of Experimentation

Process of Experimentation

Technical in Nature

Technical in Nature

Why Partner with Avizo?

To successfully navigate claiming an R&D Credit, you should partner with a firm that has experience in accurately assessing R&D activities and determining eligibility.

✅ Tailored – We work closely with your team to uncover all eligible activities and expenses

✅ Comprehensive – From documentation to calculation, we handle every step

✅ Audit-ready – We prepare clear substantiation and technical memos that stand up to IRS scrutiny

✅ Value-driven – We focus on maximizing your credit while minimizing disruption to your team

Whether you’re a startup or an established enterprise, these credits can significantly reduce your tax liability—and we’re here to help you claim what you’ve earned.

Ready to see if your business qualifies? Schedule a consultation with our team to explore your potential R&D Credit benefits. We’ll guide you through the process and make it easy to take advantage of this powerful tax incentive.

Elizabeth Hope

Elizabeth is a Supervisor in our tax department. With over six years of experience, she enjoys the opportunity to dig into unique strategies to help our clients minimize tax liabilities.