Construction-based companies can claim R&D credits for a range of activities related to new building projects. Construction projects often involve technical uncertainty, which is one of the indicators of an qualified R&D research activity. Even contractors working in Mechanical, Electrical, and Plumbing have activities within large construction projects that can be eligible.

Examples of Qualified R&D Research Activities for the Construction Industry

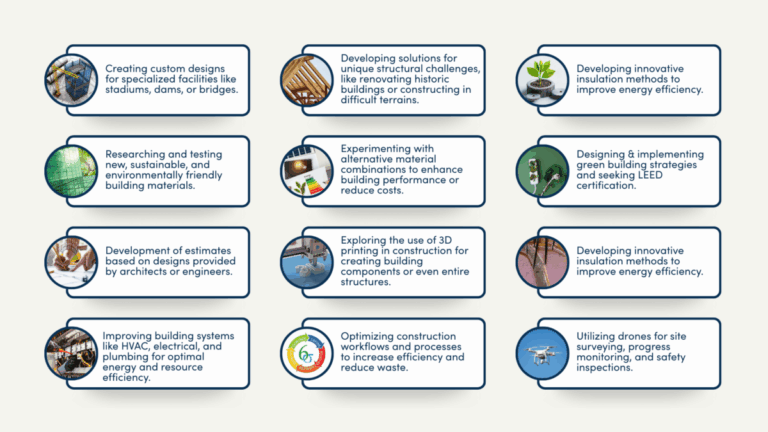

There are numerous ways a firm in the construction industry can qualify for an R&D credit. Examples below include ideas for developing new or improved materials, advancing techniques and processes, improving building performance and sustainability, applying technology and automation, and overcoming technical challenges.

Contact Us to Get Started

Ready to see if your business qualifies? Schedule a consultation with our team to explore your potential R&D Credit benefits. We’ll guide you through the process and make it easy to take advantage of this powerful tax incentive.

Elizabeth Hope

Elizabeth is a Supervisor in our tax department. With over six years of experience, she enjoys the opportunity to dig into unique strategies to help our clients minimize tax liabilities.