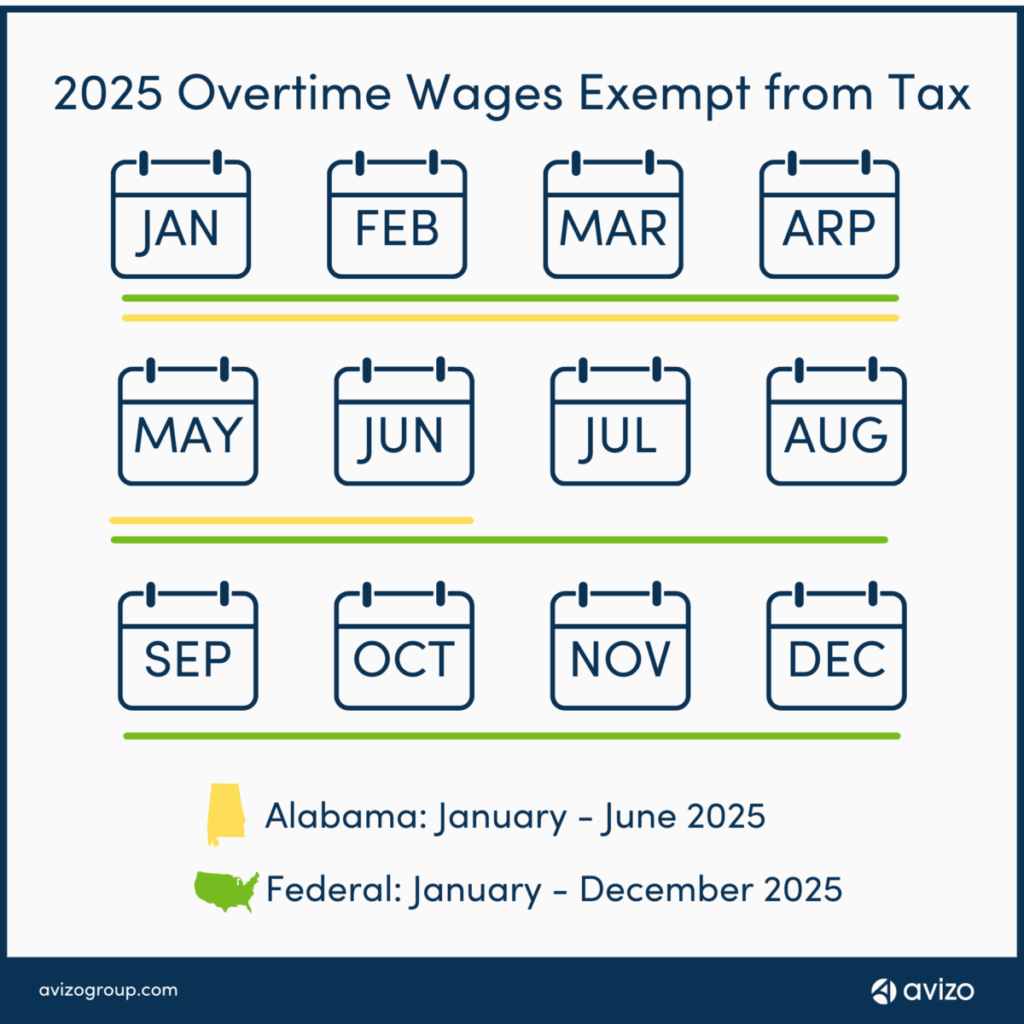

Eliminating tax on overtime is not a new concept for Alabamians. From January 1, 2024, through June 30, 2025, the Alabama state tax of 5% was excluded from overtime hours on paychecks across the state. Although the state tax on overtime returned July 1, 2025, thanks to the One Big Beautiful Bill Act (OBBBA), federal taxes will now be eliminated from overtime hours through the year.

The No Tax on Overtime is one of four pieces of new legislation that reflect initiatives President Trump supported during his presidential campaign: No Tax on Tips, No Tax on Overtime, a Car Loan Interest Credit, and a Senior Tax Deduction. Each of these are currently set as temporary and will apply to tax years 2025 (right now!) to 2028.

How ‘No Federal Tax on Overtime’ Will Work

The amount of the deduction is up to $12,500 ($25,000 for joint returns) for each taxable year – starting now in 2025 – and ending in 2028. This means you can reduce your taxable income by up to $12,500 as long as you earned that much in overtime pay the course of a year. For example, if you earn $60,000 in a year and $8,000 of that is overtime pay, you can deduct that $8,000 and only pay Federal tax on $52,000 ($60,000 – $8,000). If you earn $60,000 and $35,000 of that is overtime pay, you can still only deduct up to the maximum of $12,500, so you will pay Federal tax on $47,500 ($60,000 – $12,500).

It is an “above the line” deduction, which simply means that you do not need to itemize on your return – anyone who is eligible can take the deduction. The amount of overtime hours worked will be stated on your W2 or 1099 and your accountant will be able to reduce your income by your OT amount.

The deduction has a phase-out for those earning higher wages. The deduction is reduced by $100 for each $1,000 of a taxpayer’s modified adjusted gross income (MAGI) of $150,000 for single filers and $300,000 for married filers. For instance, a single filer with a MAGI of $160,000 has $10,000 over the limit. They must reduce their deduction by $100 for each $1,000 over the limit which means they can deduct $11,500 from Federal taxes.

Overtime Tax: Alabama and Federal for 2025

An important note is that unless your state changes its tax guidelines to match, you will still owe state tax on the full amount of income. (Alabama is different for 2025 and will be discussed in the next section.) Similarly, the entire tip amount will be included in your income and is subject to payroll taxes such as Social Security and Medicare). If you live in Alabama, this will be slightly complicated for 2025.

Prior to the enactment of the OBBBA, Alabama was the only state that attempted to eliminate tax on overtime hours worked. However, the trial phase ended halfway through the 2025 year. With the OBBB starting the no tax on overtime retroactively to January 1, 2025, if you work in Alabama, your filing will report OT hours worked January 1st – June 30th for Alabama (which should have already been reported by your employer) and then the entire year for Federal. Tracking and reporting guidelines for the OT hours for the Federal deduction have not yet been set.

Who Qualifies for No Tax on Overtime

Qualified Overtime Compensation

40+ Hours

Married - File Joint

Questions

For an employer, this will likely require a changes in your payroll processes to track and report the OT hours through the year since in Alabama, we have to track two different time periods. For the employee, the overtime amounts will be reported on their W2 or 1099 and the deduction will be taken on their personal tax returns.

Even though we may see more specifics from the IRS on this, if you work and get paid overtime, you can look forward to reduced income when you file next year. If you have any questions about this process, please contact our team.

Crissy Bonifay

Crissy is Avizo’s payroll pro. Having been with the firm for 25 years, she’s developed many talents, and we rely on her to be our go-to guide for payroll deadlines, processes, and software.