Last week, we shared information about how Medicare premiums increase (drastically) as income levels rise. This is something everyone needs to consider as part of their retirement plan because it can affect the amount and the timing of withdrawing money from your various accounts. This week, we want to provide information on three income streams to that could affect your Medicare premiums.

Medicare Premium Review

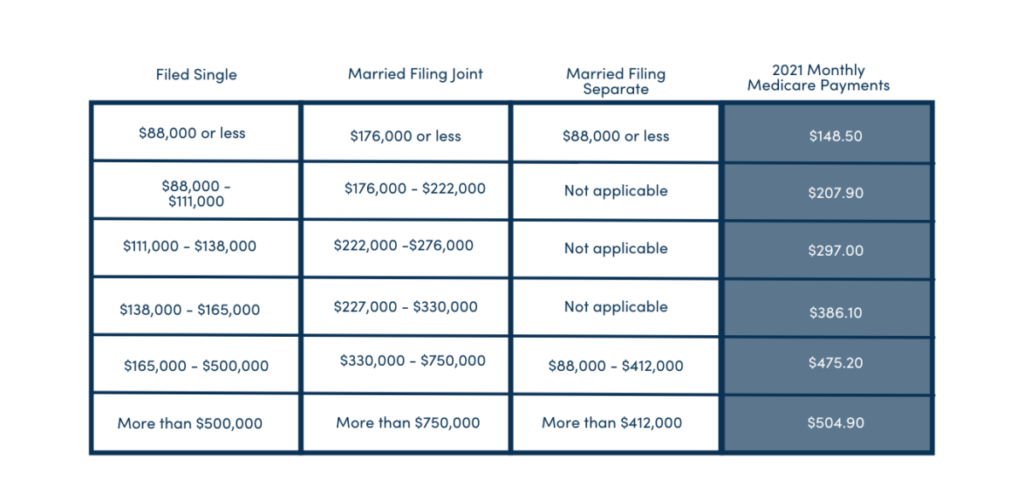

As a review, since the implementation of the Affordable Care Act in 2010, as a retiree’s modified adjusted gross income (MAGI) surpasses certain income threshold levels, Medicare premiums increase. On the right, you can see a chart for this year as an example of how much the premiums increase based on income levels. Below are three items to note regarding the calculation and coverage of the Medicare premiums.

Two Years

Medicare Part B

Just $1 Over

3 Income Streams

Essentially, what we’re saying is that you need to be aware of your MAGI every year – because it could greatly affect you two years later when it comes to Medicare. Planning for retirement can be tricky because there are many factors that could affect your income. These three income streams are ones that most people will need to consider when thinking about income.

- Roth conversions increase your MAGI for the current year. They also can lower your MAGI in future years, so you want to consider the full impact. Be aware that if you use a Roth conversion strategy, you should pay attention to potential Medicare Income-Related Monthly Adjustment Amount (IRMAA) as well.

- Your Social Security amount will be adjusted to your income, so life-changing events such as divorce/annulment, death of a spouse, and loss of pension income could affect the amount of Social Security (and the taxable amount) you’ll receive.

- You’ll need to pay attention to Required Minimum Distributions. If this puts you over the income threshold, you could consider making a qualified charitable distribution or another mitigating strategy.

If your retirement plan does not consider Medicare premiums in relation to these factors, please click the button below. We’re available to review and assist with amending your plan if needed.

Earl Blackmon, CPA

Avizo Group offers Wealth Management for clients who would like assistance in investing, saving, and portfolio diversification. This is an area of need for many of our clients who want to invest but need someone they know and trust to help them. Earl Blackmon holds a Series 7 and Series 66 license.