We all know there are multiple items to consider before you retire. From life life insurance to Social Security to estate planning, every retiree needs to have a plan in place to ensure they will reach their goals for lifestyle and legacy. However, when people think of planning for retirement, one important area they tend to overlook is their income level in relation to Medicare.

Medicare & Income Level

Since the implementation of the Affordable Care Act in 2010, a retiree is required to pay higher Medicare premiums as their income level rises.

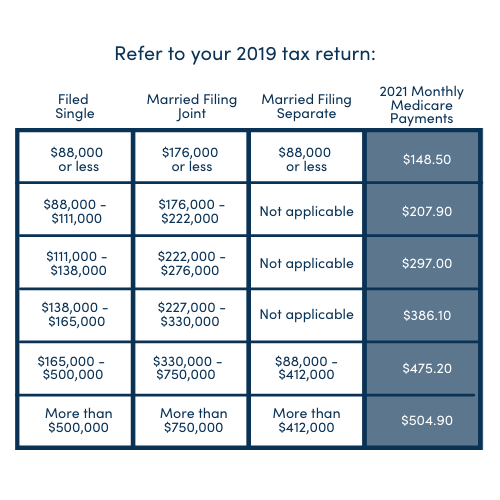

Medicare premiums for the current calendar year are based on modified adjusted gross income (MAGI) from two calendar years previously. (Premiums in 2021 are based on 2019’s MAGI.) For Medicare premiums, MAGI equals your adjusted gross income plus your tax-exempt interest.

As you can see in the chart provided, Medicare premiums increase as MAGI surpasses certain income threshold levels. The amount in the right-hand column is referred to as the Income Related Monthly Adjusted Amount (IRMAA).

There are a few more rules to note.

- Medicare has several options, but for this blog, we’ll explain Part A and Part B.

- Medicare Part A typically does not require a monthly premium. It covers hospital insurance (generally includes inpatient hospital stays, skilled nursing care, hospice care, and limited home health-care services).

- Medicare Part B is medical insurance. Though not a REQUIREMENT, most people need to enroll in Part B because it covers preventative care, medical equipment, physical therapy, etc.

- The premiums listed in the chart are for Medicare Part B. $148.50 is the standard premium in 2021 and anyone under the thresholds listed has to pay the standard.

- If your MAGI exceeds an income threshold by a single dollar, your monthly premium increases for each spouse covered by Medicare.

Create a Strategy

Whether you are a high-income taxpayer or not, it’s wise to create a plan for retirement. However, if you are a high-income taxpayer, it’s vital to have someone who can guide you through the additional complexities. At Avizo, we can help you create a fluid strategy to determine how much (and when) to withdraw funds from various savings accounts in retirement.

Earl Blackmon, CPA

Avizo Group offers Wealth Management for clients who would like assistance in investing, saving, and portfolio diversification. This is an area of need for many of our clients who want to invest but need someone they know and trust to help them. Earl Blackmon holds a Series 7 and Series 66 license.