A donor advised fund (DAF) is essentially an investment account that is established and funded for the sole purpose of supporting charitable organizations you care about. It is a tax-advantageous way to give to your favorite charities in years when you need to offset income. Some of the positives when using a DAF are that you can contribute a range of assets, the tax deduction is immediate and then on top of that, if the funds are invested, your contribution can grow tax-free before being given to a charitable organization. Some of the things that may be a drawback are that the donation is irrevocable and you can only donate to IRS approved 501(c)(3) organizations. Read more details below.

The Process of Setting Up a Donor Advised Fund

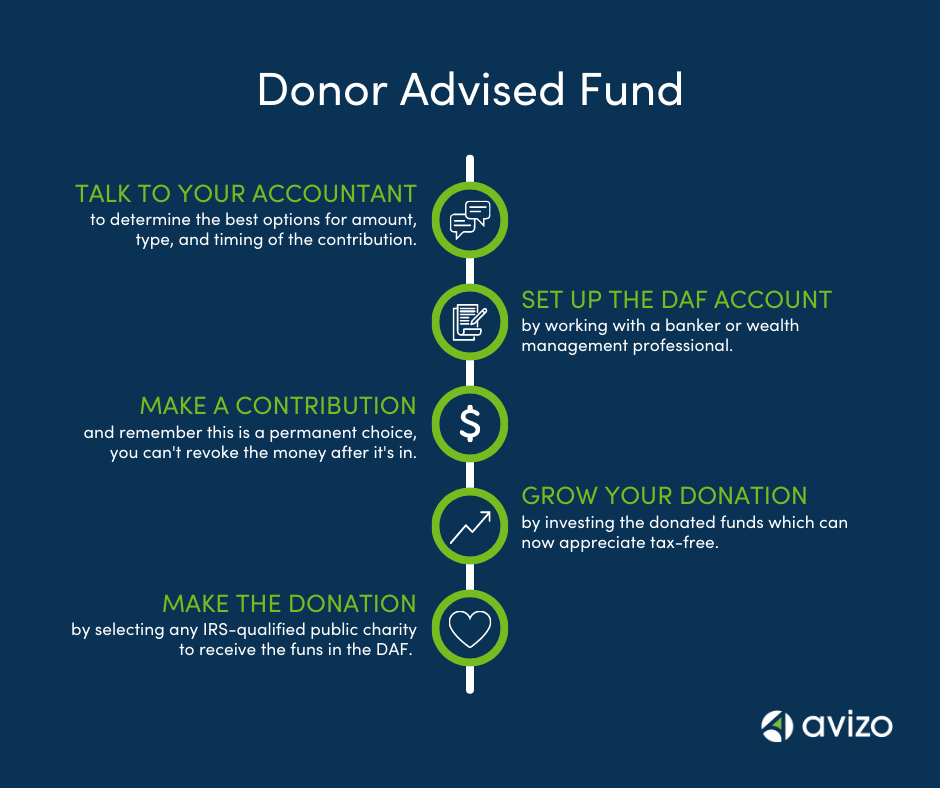

Ideally, your first step when considering a donor advised fund is to meet with your accountant who can provide advice on what type of asset you should donate, how much to contribute and when the timing is best for you. It’s important to know that once you contribute to a donor advised fund, you can’t get the money back – the funds (and their growth) may only be given as a grant to an IRS-qualified public charity. After you’ve talked with your accountant, it’s simple, just follow these four steps.

Work with a Wealth Management professional or with a banker to open your donor advised account.

You can do this as a one-time event, or you can give as many times and in as many years as you’d like to do so. You can donate cash, stocks, bonds, mutual fund shares, private company stock, cryptocurrency, life insurance, and money in a 401(k) or IRA (as long as it’s not in the form of an IRA qualified charitable deduction).

You will have investment options and if you work with a wealth management professional to set up a growth strategy, you could add to the amount that is given to your chosen charities.

You can give to a local group, to your church, to your alma mater, there are many options – but ONLY if the organization is in the list of IRS-qualified public charities.

Tax Benefits of a Donor Advised Fund

The contribution, growth, and donation process is relatively easy to achieve, but it’s important to understand the tax and financial implications before setting up a donor advised fund. To reduce your tax burden, you must itemize instead of taking the standard deduction to receive the immediate tax deduction. If you meet that criteria annually, or if you have a year when cash is increased to allow you to meet it, a donor advised fund is a way to reduce your tax liability. For 2023, the deduction is generally limited to 50% of adjusted gross income (AGI) – but cash is 60% of AGI and non-cash assets that are held for more than one year are 30% of AGI.

Tax-Free Growth

Reduce/Eliminate Capital Gains

5 Year Carry Forward

Two Restrictions of a Donor Advised Fund

The primary restriction is that the donation can only be made to an IRS-qualified public charity. This means you can’t use your donor advised fund to support non-501(c)(3) organizations, crowdfunding, or private organizations. You also are prohibited from using the donation for any kind of personal benefit, such as funding a grant to pay for a grandchild’s tuition or tickets to a charity event you want to attend.

The other restriction is that you can’t make a Qualified Charitable Donation (QCD) from your IRA into a donor advised fund. A QCD is a different method for donating to charitable organizations has its own tax benefits, so you can’t double dip and do both with the same funds. If you’re at the age where a required minimum distribution is required, you may want to discuss the difference in a DAF and a QCD with your accountant.

If you’re interested in learning more about a donor advised fund, our team of advisors is ready to help. Please click the button below to get a meeting set up.

Sally Wagner, CPA

Sally has been part of our firm since we were formed in 1990. She is a go-to consultant on tax planning and tax savings strategies for individuals and small business owners.