Signed by President Donald Trump on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) enacts new legislation that will affect the financial lives of all American citizens -and in particular, there is a Senior Tax Deduction that creates extra savings for U.S. taxpayers aged 65 and older.

Within the OBBBA, there are four pieces of new legislation that reflect initiatives President Trump supported during his presidential campaign: No Tax on Tips, No Tax on Overtime, a Car Loan Interest Credit, and a Senior Tax Deduction. Each of these are currently set as temporary and will apply to tax years 2025 (right now!) to 2028.

How the Senior Deduction Will Work

The amount of the deduction is $6,000 and the only qualifications are that the taxpayer should be over the age of 65, have a Social Security Number, and be below the income thresholds. The deduction will apply when you file your 2025 tax returns in April and will be a deduction through tax year 2028. Each taxpayer can begin taking this in the year you turn 65, so for example, if you are 63 and your spouse is 66 in 2025 – you can start taking the deduction in tax year 2027 and your spouse can apply it in all four years.

It is an “above the line” deduction, which simply means that you do not need to itemize on your return – anyone who is eligible can take the deduction.

The deduction has a phase-out for those earning higher wages. The deduction is reduced by 6% when a taxpayer’s modified adjusted gross income (MAGI) exceeds $75,000 for single filers and $150,000 for married filers.

Permanent Modification of the Tax Bracket and Standard Deductions

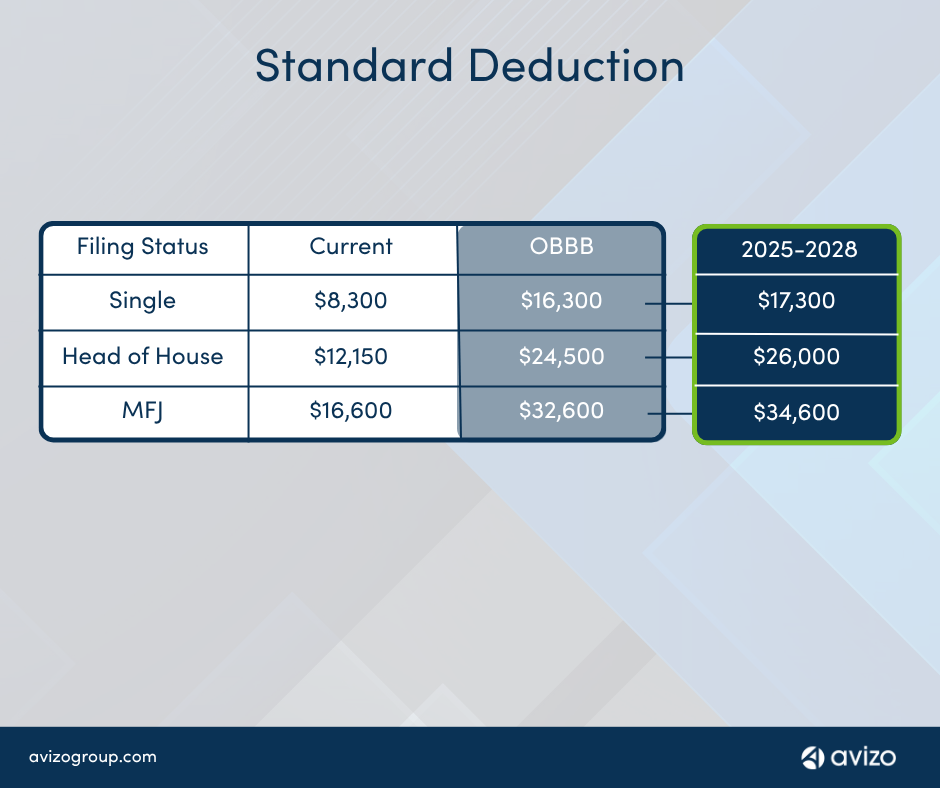

This “bonus” deduction will make a greater impact because OBBBA also permanently increases the standard deduction – with an added increase for 2025 – 2028.

In 2017, Trump’s first administration passed the Tax Cuts and Jobs Act (TCJA), which made major modifications to the long-existing tax code. Many of the tax-based changes in the OBBBA extend or make these measures permanent. A primary extension from TCJA that will affect older Americans is the permanent modification of the federal income tax bracket schedule and lowered tax rates created by the TCJA, which were set to expire after 2025. Now, the standard deduction is nearly doubled – and more than doubled for 2025-2028. The senior deduction will be in addition to this.

The biggest caveat is that in 2028, both the standard deduction will decrease (only slightly) and the entire $6,000 bonus deduction will be gone. We have some time – and it could be extended – but those taking advantage of this deduction should be aware that it is temporary.

Alabama Retirement Income Exemption

In addition to the Federal bonus deduction for seniors, Alabama separately passed a measure to exempt additional retirement income from state taxes starting in tax year 2026. For individuals aged 65 and older, the exemption will double from $6,000 to $12,000 starting January 1, 2026.

Questions

This is a new deduction, but it is fairly straightforward. As a taxpayer, you won’t need to do anything at tax time to take advantage of the extra $6,000 deduction. If there are any changes to the OBBBA or the implementation from the IRS, Avizo will share information as we learn, so be sure to follow our social media pages to stay in the loop.

Javier Ahumada, MBA

Javier brings a unique perspective to our team. Serving as an Accountant I, he plays a crucial role in providing expertise in tax, assurance, and client accounting services. Javier is continually learning new methods to assist our clients in achieving their financial goals and optimizing their business operations.