An audit is an important service for many organizations because an external financial audit completed by an accounting firm is the highest level of assurance you can get. It is the process of performing procedures to obtain audit evidence related to the amounts and disclosures in an organization’s financial statements in order to provide an independent opinion that management has fairly presented the financial statements. However, an audit is an in-depth process that can be both expensive and time-consuming for an organization, so it is not always the service we recommend. There are a few specific reasons why an organization may need to get an audit:

Outside Party Requirement

Internal Requirement

Capital Campaign

Single Audit

An audit must be performed by an independent third party. This means that the auditors cannot have personal ties to the organization in any way. This is important because an independent auditor can provide an unbiased and objective view while providing honest and candid feedback to an organization. Independence also creates a better sense of trust for those using the audit report/financial statements.

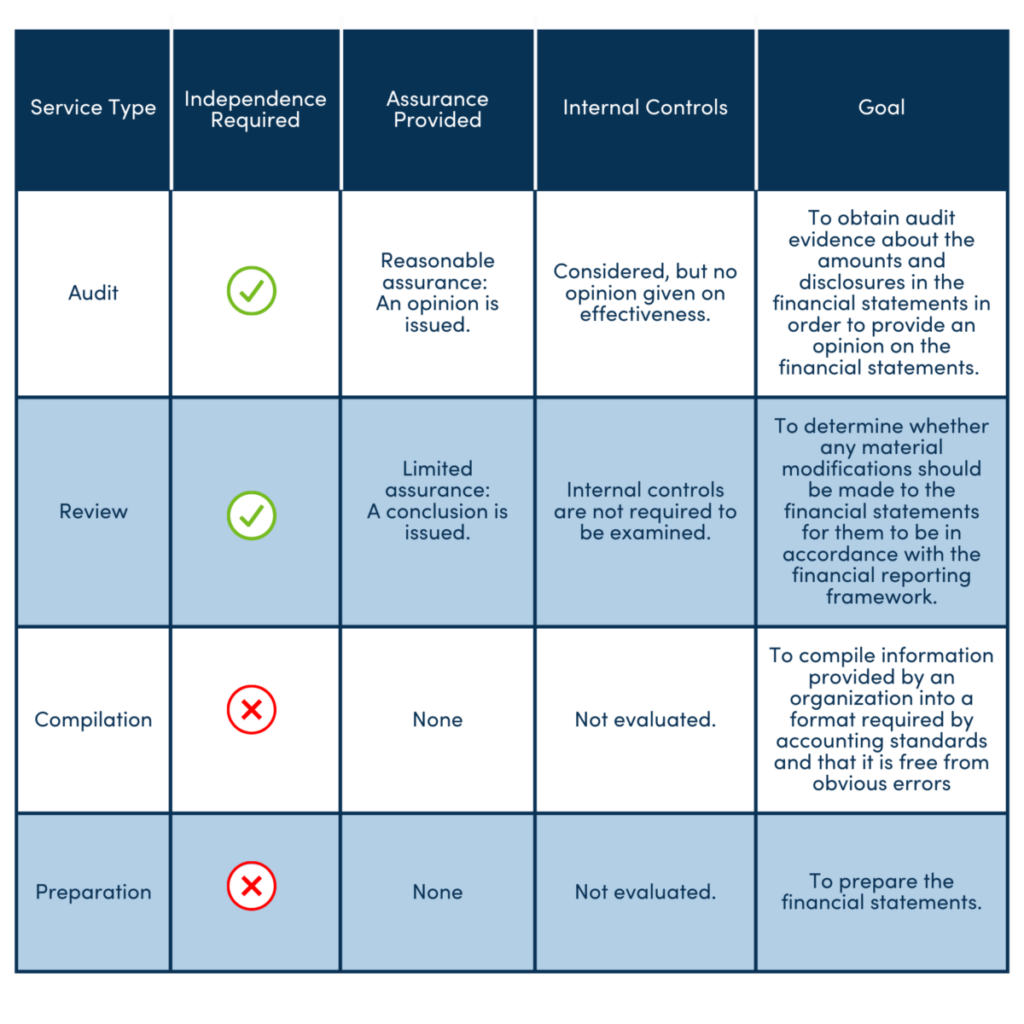

As you can tell, a lot of vetting and effort goes into each audit performed. While an audit is the highest level of assurance, it is not always the right solution for an organization. If your organization is considering getting an audit, but you don’t meet the criteria listed above for needing one, there are several other assurance services you may want to consider

Other Types of Financial Reporting

Review

One step down from an audit is a service called Review, which shares the same goals of an audit, but is not conducted with the same level of investigation or analysis. The objective of a Review is to evaluate the organization’s financial statements by inquiring and performing analytical procedures. By doing so, the CPA will determine if they are aware of any material modifications that should be made to the financial statements for them to be in accordance with the financial reporting framework.

The major differences between an Audit and a Review is that the accountant will issue a conclusion, not an opinion, which only provides “limited assurance” that the financial statements are free of misrepresentations.

Compilation

The next level of assurance service we can provide is a Compilation. With this service, the accountant will not provide an opinion (like they do in an audit) or a conclusion (like they do in a review). In fact, no assurance is provided. The accountant compiles your organization’s financial records into the financial statement format required by accounting standards so that that it is free from obvious misstatements.

With a compilation, the accountant does not verify or test the accuracy for any of the source documents provided by the organization.

Preparation

Preparation is when an accountant is engaged to prepare the financial statements. An accountant who prepares the financial statement cannot also be engaged to perform a compilation, review or an audit on those financial statements. Under this service, the accountant must provide a statement ensuring the reader that the financial statements have not been audited. They can do this in the form of an accountant’s report or as a a legend on each page of the financial statements stating that no assurance is provided on the financial statements.

Assurance Services

These are the four financial reporting services offered within our assurance department, but there are other services we provide that can meet specific goals. We can set up a project to evaluate your internal controls, give your team a presentation on fraud, or perform an agreed upon procedures engagement focusing on specific areas of your accounting function. If you’d like to learn more about our assurance services, please reach out.