At the end of each year, business owners must get information together to complete their 1099 filings. 1099-MISC and 1099-NEC forms are required to be filed by February 1st to anyone (excluding employees and corporations) who did more than $600 worth of work for your organization throughout the year.

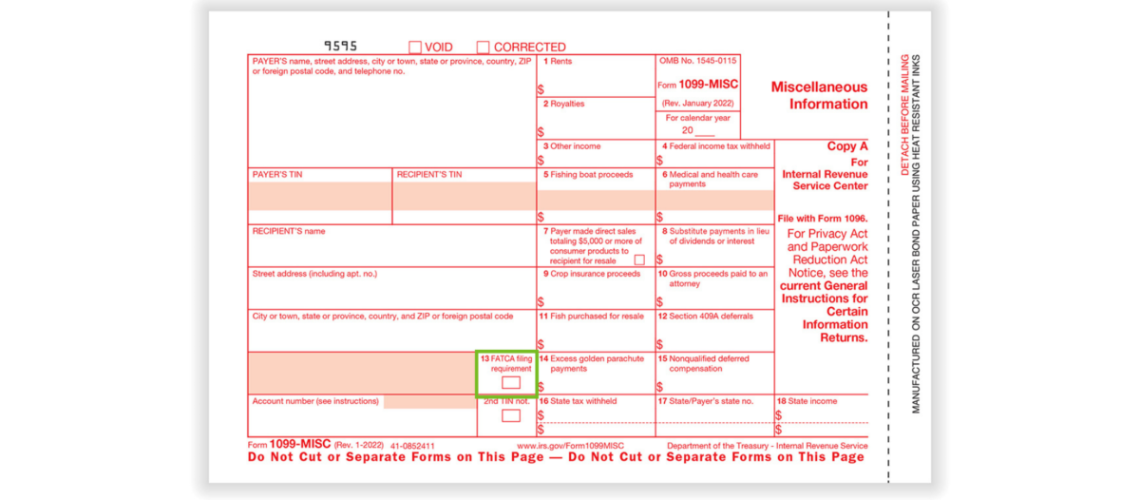

The IRS made six changes to the 1099-MISC for the 2022 filing, most of which are just moving information into a different box on the form. The only addition is the FATCA Filing Requirement checkbox, which can now be found on Box 13. Boxes 13-17 from the 2021 version of the form have been renumbered as 14-18 to accommodate this change. Preview the changes in the next section.

2022 Form 1099 Changes

Box 13: FACTA

Box 14: Golden Parachute Payments

Box 15: Nonqualified Deferred Compensation

Box 16: State Withheld Taxes

Box 17: Payer's State Number

Box 18: State Income

When to Give a 1099-MISC

As a business owner, you are responsible for sending a 1099-MISC if you make payments for any of the following:

1099-NEC is for Independent Contractors

According to the IRS, “non-employee compensation” is defined by all the following:

- Payments made to an individual (freelancer, contractor, etc), a partnership, or an estate.

- Payments made for services in the course of your trade or business.

- The payments totaled at least $600.

Exemptions from 1099 Filings

As with all “rules”, there are exemptions to filing a 1099. However, if you’re ever in doubt, the best course of action is to just fill the form out. If you fail to file a Form 1099-MISC when the IRS deems that you’re obliged to, you will have to pay fines and penalties. Here are the exemptions:

Payments made to corporations considered S-Corps or C-Corps are exempt. That includes LLCs considered S-Corps or C-Corps.

Payments made to someone who performs duties related to managing rental properties and finding successful tenants to fill vacancies in rental properties are excluded.

Payments for utilities, freight, and storage are typically exempt.

If you pay someone via credit card or third party payment system, such as PayPal, you do not report those payments.

Payments such as wages or salaries to employees are exempt. This includes payments for business travel and associated expenses. Instead, these payments should be included in the employees W-2.

A Form 1099- filing is meant for payments made for the purposes of running your business. You are not obliged to fill the form for personal payments.

An Annual Timeline for 1099 Filing

You’ll need the person doing the work to provide you with a W-9 to show their taxpayer number. This is easiest to do through the year as you go. Any time you exceed $600 in payments, require a W-9 before sending payment. (The requirement of a 1099 is on YOU – you can’t blame them if they don’t give you the W-9).

Towards the end of the year (November/December) you need to make list of who gets which type of 1099. (Don’t forget about the people you may pay who need a form at the end of the year though!)

- Ensure you have the W-9 and if any are missing, get them now!

- Calculate the total amount of payment made to each account.

- Double check that you aren’t duplicating a vendor based on spelling mistakes.

- Make sure to distinguish 1099 designees properly in your accounting software.

You can order the forms free from the IRS or you can find them in some office supply stores. Sometimes you can even find a copy built into payroll software and other services you use. *Please note: The IRS website provides a PDF you can look at for reference, but you may not download it and fill it out.

If you followed Steps 1 and 2, this part is easy. Once you acquire the form, all you need to do is accurately fill it out and send each copy to its destination.

- MAIL: If you mail the form, you must also file a Form 1096 transmittal form to the IRS with Copy A.

- EFILE: If you e-file your Form 1099-MISC or 1099-NEC, you do not need to fill the Form 1096.

Each Form 1099-MISC and 1099-NEC includes 2 necessary copies. There will be a Copy A you must give to the IRS and Copy B you must give to the payment recipient.

You are required to provide Form 1099-MISC and 1099-NEC to non-employees you’ve paid over $600 to before February 1st. It’s a good idea to send the forms out early. If you can get each Form 1099-MISC or 1099-NEC to non-employee payment recipients by mid-January, they should have time to review the form and correct any issues they see.

Filling an accurate Form 1099-MISC or Form 1099-NEC for each non-employee is very important. If you pay for the services of a non-employee and fail to file the form, you can be fined $100 for each type of form.

If you file after the deadline, you will have to pay a fine based on:

- How late you pay

- The size of your business

When you use Avizo’s Client Accounting and Payroll solutions, we can guide you through this process, or even keep up with your list and accumulated W-9s to file for you in January. Contact us if you’re interested in spending your time running your business instead of keeping up with all this paperwork!

Kim Pendley

Kim is a valued member of our CAS and tax teams. If you’re a business owner and your books are a mess – Kim can fix it. She has 25+ years of experience in nonprofit & governmental accounting and financial reporting as well as individual taxation (specifically LLCs or rental property).