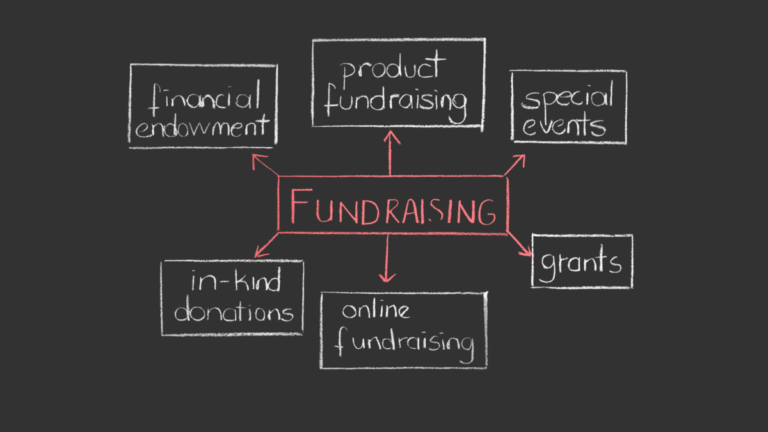

Nonprofit Audit vs. Other Assurance Services: How to Know What You Need

A nonprofit needing assurance services does not always need an audit. This blog shares the difference between audits and other assurance services.

FAQs, Ideas, and Information to Help You Grow

A nonprofit needing assurance services does not always need an audit. This blog shares the difference between audits and other assurance services.

One of the most common and damaging forms of fraud today is check washing, a scheme that can quietly drain business accounts if left unchecked.

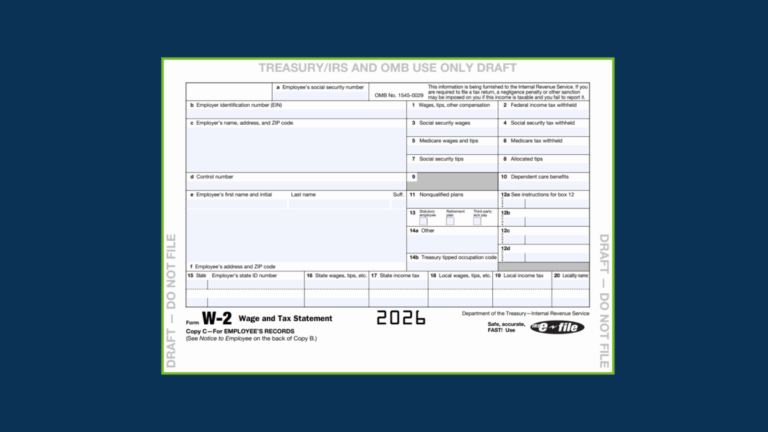

The IRS is not requiring employers to report overtime wages earned on the 2025 W-2, but you still need to know your total so you can take advantage of federal and state deductions

Filing 1099s is part of year-end for every business. Here’s a guide for what you need to know and the timeline for when you need to have each step completed.

Tips for year-end tax planning to make 2026 your best year yet!

After 9/30/2025, you can no longer receive or mail paper checks to Federal agencies, including the Internal Revenue Service (IRS), Social Security Administration (SSA), and the Department of Veterans Affairs (VA).

520 Plans have been updated under the last several administrations. Learn the updates and what the newest round of changes under OBBBA brings.

Learn about how the tax law changes under the OBBBA will affect nonprofits.

The IRS has released a draft of the 2026 W-2 and filing instructions to address No Tax on OT and No Tax on Tips from the OBBBA legislation.

If you’re curious about a topic or just have a question, drop us a line on what you’re wanting to know more about. You just might find the answer posted in our next blog!