Whole life insurance is designed to remain in force for your whole life, as long as you remain current with your premiums.

Whole Life Insurance

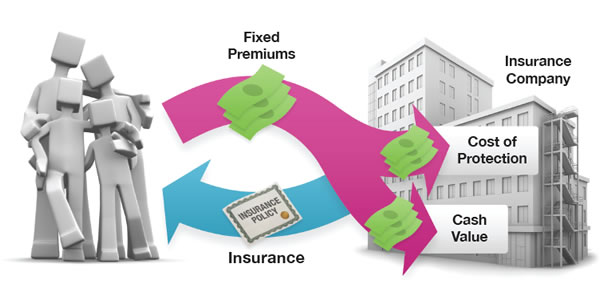

In exchange for fixed premiums, the insurance company promises to pay a set benefit when the policyholder dies. Whole life insurance policies can build up cash value — effectively a cash reserve that pays a modest rate of return. This growth is tax deferred. Guarantees are based on the claims-paying ability of the issuing company.

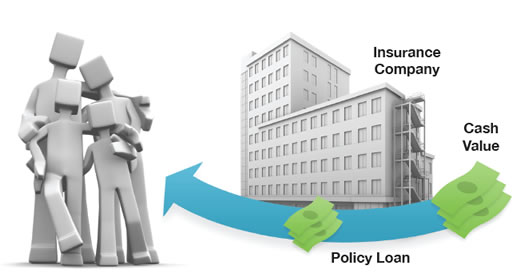

Most whole life insurance policies allow policyholders borrow a portion of their policy’s cash value. Interest payments on policy loans go directly back into the policy’s cash value.

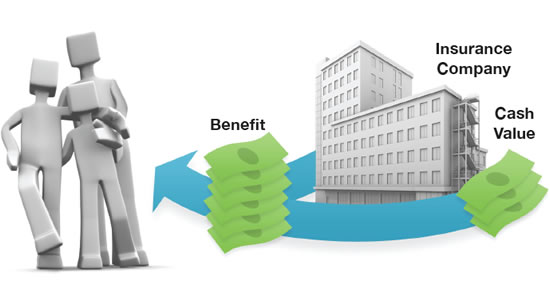

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

Is Whole Life Insurance Right for You?

Whether whole life insurance is the best choice for you may depend on a variety of factors, including your goals, needs, and circumstances. Accessing the cash value of the insurance policy through borrowing — or partial surrenders — has the potential to reduce the policy’s cash value and benefit. Accessing the cash value may also increase the chance that the policy will lapse and may result in a tax liability if the policy terminates before your death.

Keep in mind that several factors will affect the cost and availability of life insurance, including age, health and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder may also pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Life insurance is not insured by the FDIC (Federal Deposit Insurance Corporation). It is not insured by any federal government agency or bank or savings association.

Generally, loans taken from a policy will be free of current income taxes, provided certain conditions are met, such as that the policy does not lapse or mature. Loans and withdrawals reduce the policy’s cash value and death benefit. Loans also increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance will be considered a distribution and will be taxable.

Avizo Wealth Management

Just like everything else we do, Avizo Group’s Wealth Management services are client-centered. Whether you are investing to build wealth, protect your family, or preserve your assets, our personalized service focuses your needs, wants, and long-term goals. Contact ustoday to learn more about how he can help you.

Earl Blackmon, CPA

Avizo Group offers Wealth Management for clients who would like assistance in investing, saving, and portfolio diversification. This is an area of need for many of our clients who want to invest but need someone they know and trust to help them. Earl Blackmon holds a Series 7 and Series 66 license.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2021 FMG Suite.