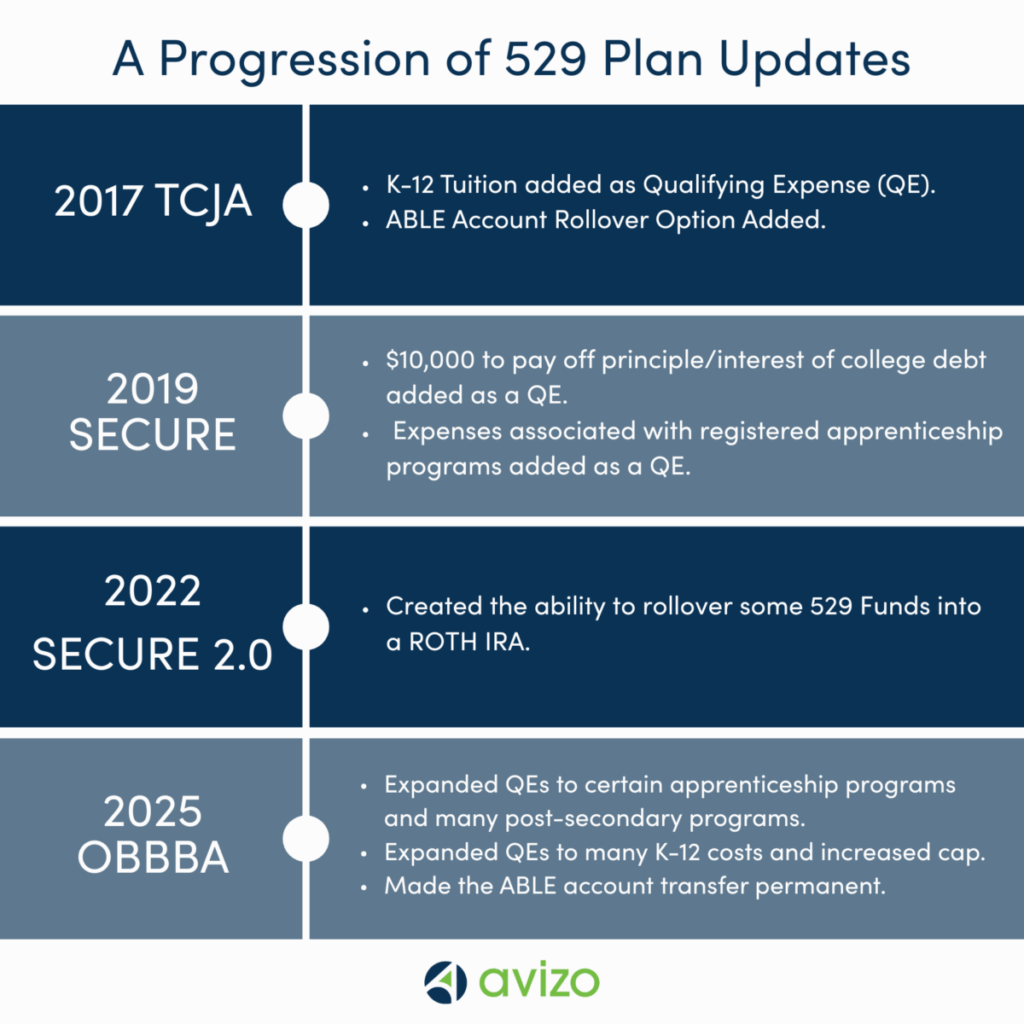

Traditionally, 529 Plans have been a useful tool as a college savings option. Over the last several years, the legislation around 529 Plans have made them a more flexible savings tool – and the changes that came with the One Big Beautiful Bill Act continue the trend of creating more options for this powerful savings vehicle. Learn about the timeline of changes to qualified expenses and additional uses below.

529 Plan Overview

A 529 Plan is an education savings plan sponsored by the state or a state agency. The benefit as a savings tool is that the money invested in a 529 plan grows tax-deferred, and qualified distributions are tax-free. As a contributor, you can’t deduct your annual contributions on your Federal return, but you can deduct up to $5,000 for single filers and $10,000 for married filers per year on your Alabama filing. Contributions are treated as a gift to the beneficiary, which means your annual contribution is generally limited to annual gift tax exclusion amount, which is $19,000 in 2025. However, parents, grandparents, and anyone else who wants to contribute can do so, up to their own cap.

Using 529 funds for Qualified Expenses is important because there are two penalties for using the money on non-qualified expenses. First, the account owner will incur income taxes on the earnings portion of the distribution used for the non-qualified expenses. Second, the owner will pay an additional 10% penalty on those earnings. Traditionally qualified expenses included the following – applied only to college-based expenses:

- Cost of room and board for students enrolled at a college or university at least half-time

- Tuition and Fees

- Books and Supplies

- Computer and Internet

- Off-Campus housing, food, and utilities (as long as the tax-free payout does not exceed the room and board allowance included in the school’s cost of attendance)

529 Changes in 2017 with the Tax Cuts and Jobs Act

First, the Tax Cuts & Jobs Act (TCJA) introduced the expansion of qualified expenses to include K-12 tuition. Second, the TCJA introduced tax-free rollovers into ABLE (Achieving a Better Life Experience) accounts. ABLE accounts provide a tax-advantaged way for individuals with disabilities to save money for qualified disability expenses.

529 Changes in 2019 under the SECURE ACT

The SECURE Act of 2019 expanded qualified expenses to include up to a lifetime limit of $10,000 to pay off principle and interest payments of college debt without having to pay Federal income tax on the withdrawal. It also expanded qualified expenses to allow tax-free withdrawals for expenses associated with registered apprenticeship programs.

529 Changes in 2022 through SECURE 2.0 Act

Next, in 2022, the SECURE Act 2.0 was signed into law which contained legislation focused on helping individuals gain more/easier access to their retirement savings. The updates included the ability to transfer 529 plan funds into a Roth IRA for the same beneficiary without paying taxes or penalties. Here’s how that works. If the beneficiary decides to skip college or a credentialing program – or if they do, but there is still money left over – SECURE 2.0 created a new option for how to use the funds by allowing beneficiaries of 529 college savings accounts to transfer up to $35,000 of unused funds over the course of their lifetime directly to a Roth IRA, with the following limitations:

- $35,000 is a lifetime cap, not an annual cap.

- Annual rollover amounts will be limited (and is set at $7,000 for most individuals and $8,000 if 50+ years old in 2025).

- The 529 must be open for 15 years before funds may be rolled into a Roth IRA.

- The beneficiary of the 529 and the Roth IRA must be the same person.

- Anything paid into the 529 in the prior 5 years can’t be rolled.

529 Changes Under the OBBBA

Finally, we get to the current changes. The primary changes under OBBBA include increased qualified expenses. Under OBBBA, qualified expenses are expanded to include the following:

- Certain apprenticeship programs

- Many post-secondary credentialing programs

- Expanded K-12costs of materials for curricula and online studying, books, educational tutoring, fees for advance placement test or college admission exams, and educational therapies performed by a licensed provide to students with disabilities.

- K-12 education expenses increased from a cap of $10,000/year/beneficiary to $20,000/year/beneficiary starting in 2026.

OBBBA also made the TCJA ability to transfer of funds from 529 plans to ABLE accounts permanent.

529 Plan Set Up

With the continued additions to qualified expenses and options for using unused funds in a 529 plan, this savings tool is a great option for parents or grandparents who want to start a savings plan for a child. You can set up a 529 in any state, but if you live here, to take advantage of the state deduction, you will want to set up your plan with Alabama’s plan, CollegeCounts. If you have questions on how setting up a plan will affect you and your family, set up a meeting to talk through it with us.

Javier Ahumada, MBA

Javier brings a unique perspective to our team. Serving as an Accountant I, he plays a crucial role in providing expertise in tax, assurance, and client accounting services. Javier is continually learning new methods to assist our clients in achieving their financial goals and optimizing their business operations.