The Research & Development (R&D) tax credit is a powerful credit for companies with a desire to innovate and increase their research activities. Changes to this credit within the One Big Beautiful Bill (OBBB), which was signed into law on July 4, 2025, makes this credit more impactful.

Under the Tax Cuts and Jobs Act (TCJA) of 2017, businesses applying the R&D credit were required to capitalize and amortize R&D expenditures over five years, starting in 2022. The OBBB allows for a permanent reinstatement of immediate expensing for domestic R&D expenditures, which reverses the TCJA’s five-year amortization requirement. It also provides for retroactive relief for the years 2022-2024 for businesses with average annual gross receipts under $31 million.

R&D Tax Credit and the One Big Beautiful Bill

The credit itself remains unchanged by the OBBB. It will continue to provide a deduction for between 6-20% of qualified research expenses, but the payout will be immediate for domestic research. Under prior law, domestic R&D expenditures had to be capitalized and amortized over five years – for many companies, the extra effort of completing this made the credit less worthwhile.

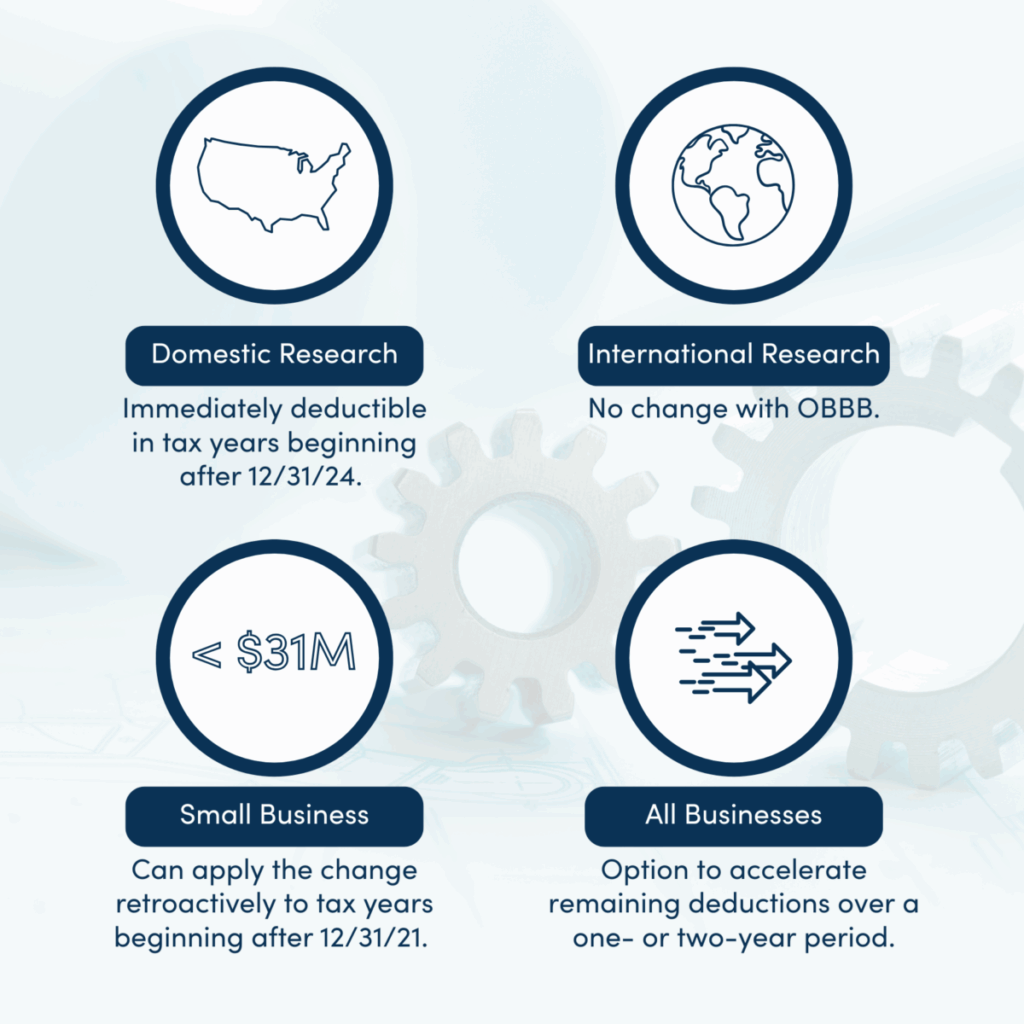

The OBBB revises this to allow taxpayers to immediately deduct their R&D expenditures. Here are the categories of how OBBB affects the R&D credit for different businesses and activities:

Taxpayers can immediately deduct domestic research or experimental expenditures paid or incurred in tax years beginning after Dec. 31, 2024.

No change. Research or experimental expenditures attributable to research that is conducted outside of the United States will continue to be required to be capitalized and amortized over 15 years under Sec. 174.

Small business taxpayers with average annual gross receipts of $31 million or less may apply this change retroactively to tax years beginning after December 31, 2021.

All taxpayers that made domestic research or experimental expenditures after December 31, 2021, and before January 1, 2025, will be permitted to accelerate their remaining deductions for their R&D expenditures over a one- or two-year period.

However, there is a short timeline to claim the credit retroactively for 2022, 2023 & 2024. This will only be available for one year from when the OBBB is effective – making your deadline July 4, 2026 for retroactive claims.

Do You Qualify for the R&D Credit?

Many business owners assume that only large organizations can leverage this dollar-for-dollar tax incentive, but the R&D credit can be used in an organization of any size – and with the passage of OBBB, you may be able to claim the credit back to 2022. Check out our Research & Development webpage to learn more and if you want to reevaluate past activities or learn how to establish a new activity that qualifies, please reach out and we can work with you to take advantage of this credit that can deliver real financial value to your business.

Elizabeth Hope

Elizabeth is a Supervisor in our tax department. With over eight years of experience, she enjoys the opportunity to dig into unique strategies to help our clients minimize tax liabilities.