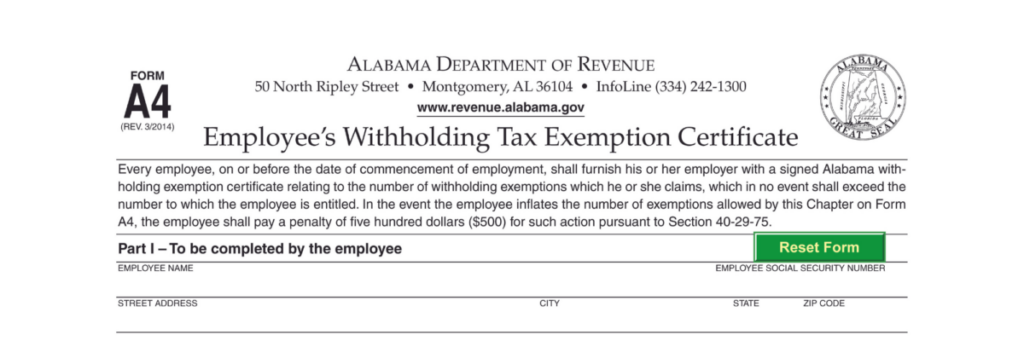

Even though starting a new job is exciting, before an employee can actually begin to work and get paid, there are numerous forms and contracts they have to sign for a new employer. In Alabama, one of those forms is the A-4. The A-4 form is the Alabama Department of Revenue Employee Withholding Tax Exemption Certificate. This is what tells your payroll provider how much money to withhold from an employees paychecks to ensure they’re paying taxes to the state of Alabama through the year. We have seen this particular form incorrectly completed so many times and in so many different ways that we decided to provide a guide on how to correctly fill out the A-4 form.

You can click on the images of the forms to read them in more detail, and you can click the button here to see a full copy of the online fillable form.

A-4 Form Part I: Basic Information

A-4 Form Part I: Details

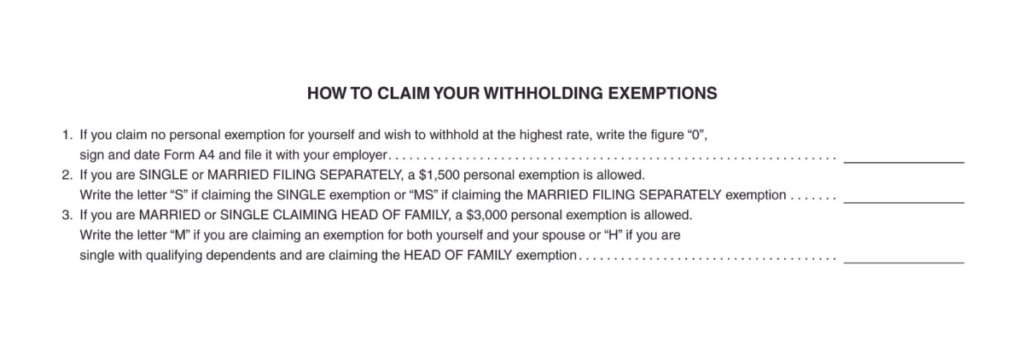

The remainder of part one where things can become confusing or complicated for employees. This section of the A-4 Form has six line items and requires a signature. We’re going to break this section down by each area you need to fill in so you can easily see how to complete them correctly.

Number 5: Additional Amounts

This item is completely optional. If the employee believes the information provided in questions 1-4 will not meet their tax liability, they can write in an additional amount to withhold from each paycheck. For instance, if the employee does contract work outside of this job, they may want to have extra taken out to cover income from that other source.

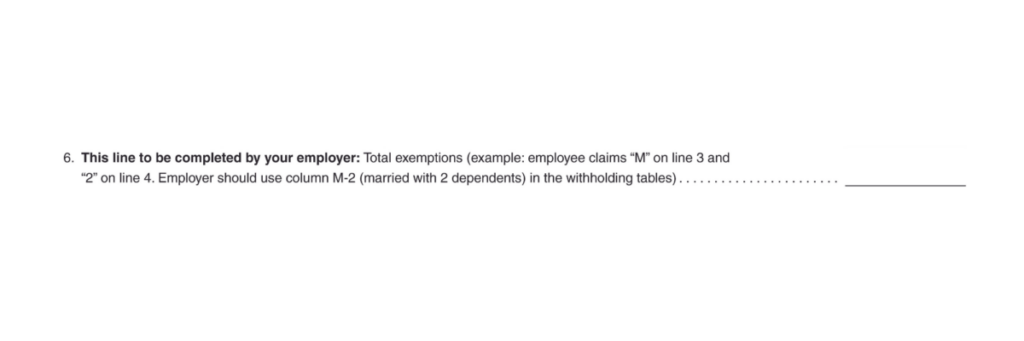

Number 6: The Employer Confirmation

The employer must fill out number 6. While completing this section, the employer can point out if any of the sections above have not been completed correctly. If it has been, the employer will look at numbers 1-3 and write 0, S, M, etc., then write a dash (-), and then the number of dependents. Examples would be S-0 (single on line 2 and no dependents on line 4) or M-3 (married on line 3 with three dependents on line 4).

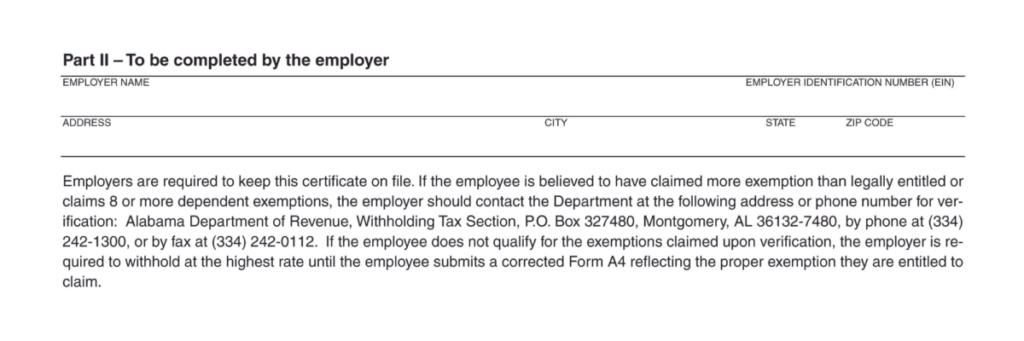

A-4 Form Part II

Part II: Employer Information

Part II of the the A-4 Form simply requests the employer’s information, which includes name, employer identification number, and address. Once this is complete, it will be entered into your payroll software. You must be sure to keep the original copy of this form in your employee’s files.

The Importance of the A-4 Form

Your employee will also be required to submit similar information on their W-4 Form, which is the Federal income tax withholding form. The A-4 Form confirms withholding for the state of Alabama. If you do not submit a tax withholding form, your payroll provider is required to withhold taxes as the highest level possible, which is single with no exemptions – even if you know the employee is married. This will result in smaller paychecks for the employee. The only prevention is to require a new employee to submit a W-4 and an A-4 that are both completely and accurately filled in.

Please feel free to download and share our PDF guide, which provides the information from this blog. If you or your employee have additional questions, your accountant can help.

Crissy Bonifay

Crissy is Avizo’s payroll pro. Having been with the firm for 25 years, she’s developed many talents, and we rely on her to be our go-to guide for payroll deadlines, processes, and software.