It’s very likely that you encounter a scam every week. A scam can come in the form of fake phone calls, emails, and even letters you get in the mail. Some are just annoying spam, but unfortunately, many are potentially harmful scams. Often, what a scammer wants to obtain is personal information or money, and that means your tax-based data is a high-value target for scammers. Luckily for the scammers, many people are fearful of the IRS and scammers prey on that emotion.

The IRS states, “Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone and email to set up individuals, businesses, payroll and tax professionals.” To help protect you, this blog covers some of the most common scams the IRS wants you to be aware of.

Common Taxpayer Scams

Mail Scams

Over the summer, one of the new scams emerged in the form of a letter. This letter attempted to convince taxpayers that they were owed a refund and in order to receive it, they needed to text or email information to a number provided in the letter. The letter is printed on what looks like IRS masthead and it explains that in order to receive a refund, the taxpayer must provide personal information to the contact information listed in the letter. Of course, the contact information and phone number do not belong to the IRS.

Because most scam letters include the IRS logo, at first glance, mail scams may look legitimate. The logo convinces people to read the letter which includes messaging that generally takes one of these approaches: 1. A promise of a refund if you provide sensitive personal information; 2. A demand of payment for unpaid taxes with a threat if you do not pay quickly.

Luckily, most of the scams are poorly executed, often containing strange wording, bad spelling, confusing formatting, and incorrect facts. If you receive a letter and feel unsure about its legitimacy, you can always use Google to find a legitimate phone number to call and ask about the letter you received.

Email/Text Scams

The IRS never initiates contact with taxpayers by email, text or social media regarding a bill or tax refund. If you receive an email or a text message, do not click links and do not respond to them. Simply delete them.

Text Message Scams: These scams are sent to taxpayers’ smartphones and often contain bogus links claiming to be IRS websites or other online tools. Other than IRS Secure Access, the IRS does not use text messages to discuss personal tax issues, such as those involving bills or refunds. The IRS also will not send taxpayers messages via social media platforms.

Email Scams: Scam emails are designed to trick taxpayers into thinking the email is official communications from the IRS or from others in the tax industry, including tax preparers and tax software companies. The messaging will try to get you to send personal or financial information. The wording will seem urgent because they want you to react immediately, but it is always better to take the time to confirm the request. If you are an Avizo client and you receive an email requesting information, please call us to confirm before sharing.

Phone Scams

Every year as tax season ramps up, criminals begin making aggressive calls posing as IRS agents in hopes of stealing taxpayer money or personal information. This is an extremely common scam.

The scammer will often say you owe money and if you do not pay on this phone call, you will be arrested, your house will be foreclosed, you will have to go to court – or some other threat. They insist immediate payment is the only way to stop the threat.

In reality, the IRS generally contacts clients by mail first, and then they might call you if you do not respond to them. If you get a phone call from someone who says they are with the IRS, but you haven’t received any other communication from them – it’s probably not the IRS.

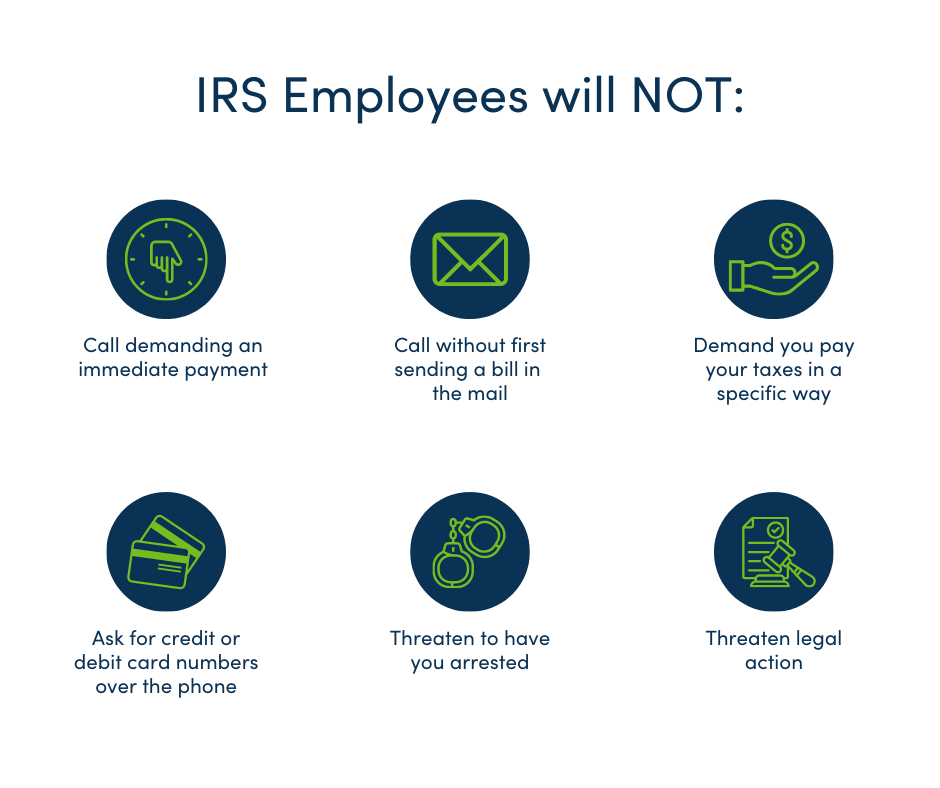

Check out our visual for tips to help you avoid being scammed.

Reporting a Scam

Every year, the IRS shares their “Dirty Dozen List” which is a list of that year’s top tax scams. These scammers work year-round, not just in tax season, so it’s important to always be on alert. If you receive a notice, an email, a phone call, a text – or any form of communication claiming to be from the IRS – please contact your accountant before sending any information. It’s better to ask them to confirm the validity of the communication than to take a risk.

Internal Revenue Service Lead Development Center

Stop MS5040

24000 Avila Road

Laguna Niguel, California 92677-3405

877-477-9135

Taxpayers and tax practitioners may also send the information to the IRS Whistleblower Office for possible monetary reward.

Taylor Clinkenbeard, CPA

Taylor is a Strategic Analyst in our tax and client accounting services teams. She has developed specific expertise in software, accounting processes, and tax laws to serve our clients.