As you review your health insurance options for 2023, consider opting into a Health Savings Account (HSA) as a wealth management and tax-saving strategy. An HSA is a type of savings account designed to save money on a pre-tax basis to pay for qualified medical expenses including healthcare deductibles and out-of-pocket costs. You generally cannot use HSA funds to pay your monthly premiums, but this still offers a way to lower your overall healthcare costs.

Requirements for a Health Savings Account

You must have a High-Deductible Health Plan (HDHP) to qualify for an HSA account. While the deductible (the amount of money you pay for covered health care services before your insurance plan starts to pay) is higher than a traditional health insurance plan, the monthly premium you pay is generally lower. Additionally, preventative care can be covered dollar-for-dollar under an HDHP even if the deductible hasn’t been met. Essentially, in an HDHP/HSA situation, you will pay the entire cost for visits to the doctor and medicine prescribed to you, but after you meet the deductible, the plan pays for the rest. If you do not go to the doctor often OR if you know you will meet the deductible really quickly, this could help you save a lot of money.

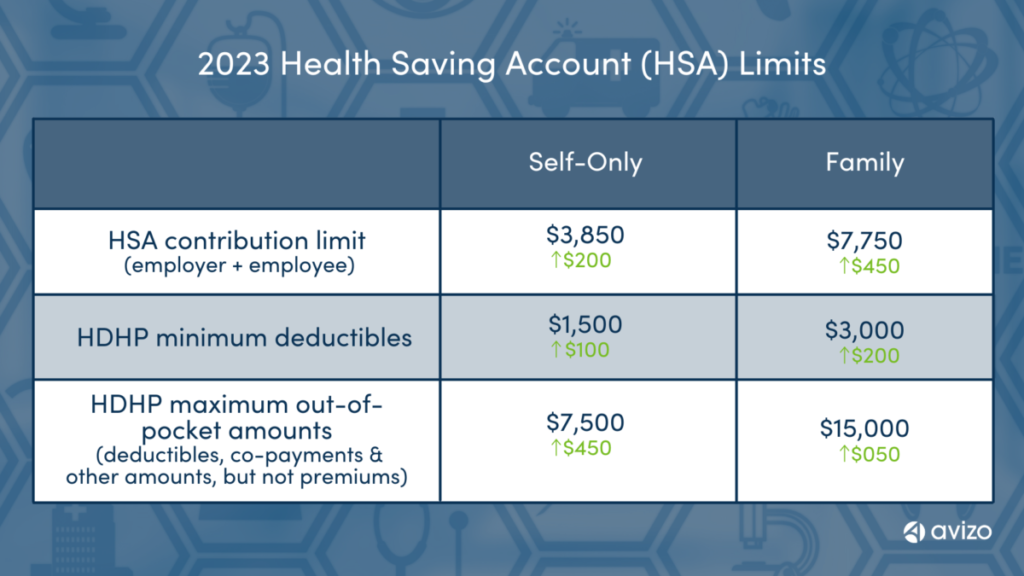

To enroll, many employers offer an HSA option, but if yours doesn’t, you can check with your bank or brokerage company to learn if you and your family meet the requirements to fund an account outside of your employer. The other requirements are the minimum allowed deductibles, which are set annually by the IRS and can be seen in the chart below:

Use an HSA as Tax Strategy

As we covered, from a healthcare perspective, the basic premise behind the HDHP/HSA combination is that you cover the (relatively) small things like filling a prescription for antibiotics, and (after you meet your deductible) insurance will cover big things like a broken bone or a surgery. From the tax perspective, an HSA is a tax-favored savings vehicle.

The money you contribute to an HSA is either added into the savings account tax-free, or you can deduct it (up to the HSA contribution limits listed on the top row of the chart).

Those who are age 55 or older can contribute an extra $1,000 each year as a catch-up.

The earnings in the HSA do not have a use-it-or-lose-it rule like Flexible Spending Accounts do, so your money can continue to grow the longer you keep the account. Additionally, any earnings that grow in your HSA are tax-free.

Aside from the obvious doctor visits, you can also use money from an HSA to purchase over-the-counter medicines (even if they are not prescribed to you) and menstrual care products. If you use the money for non-qualified purchases, there is a 20% penalty.

Use an HSA as a Retirement Strategy

In addition to saving you on taxes, you can also create a plan with your financial advisor to use an HSA as part of your retirement strategy. If you are enrolled in Medicare, you can no longer contribute to an HSA account, but if you started an HSA prior to using Medicare, you’ll have some added benefits. After you reach age 65, you can use the money in an HSA tax-free to pay Medicare premiums AND you can continue to take tax-free payouts to use for out-of-pocket medical expenses and even non-medical uses. Read more about using an HSA as a retirement strategy in this article.

Whether you want to set up an HSA/HDHP for health, tax, or retirement – we are here to help. Click the button below to contact us if you would like to learn more.

Chris VanArsdale

Chris is a Strategic Analyst who maintains expertise in litigation support, international taxation, and complex entity and fiduciary taxation services.