Earlier this week, the Federal Reserve raised its benchmark interest rate to 1.5-1.75%, which is an increase of 0.75% (three quarters of a percentage point). The Federal Rate is a suggested target of what commercial banks borrow and lend their excess reserves to each other overnight and in this instance, the goal is to help combat inflation. To you, this means an increase in borrowing rate for credit cards, car loans, and mortgage loans, and likely an eventual increase on the yields from certificates of deposit (CDs) and savings accounts. Basically, interest rates are going up – and it doesn’t look like it will be stopping anytime soon.

The Federal Reserve Rate Hike

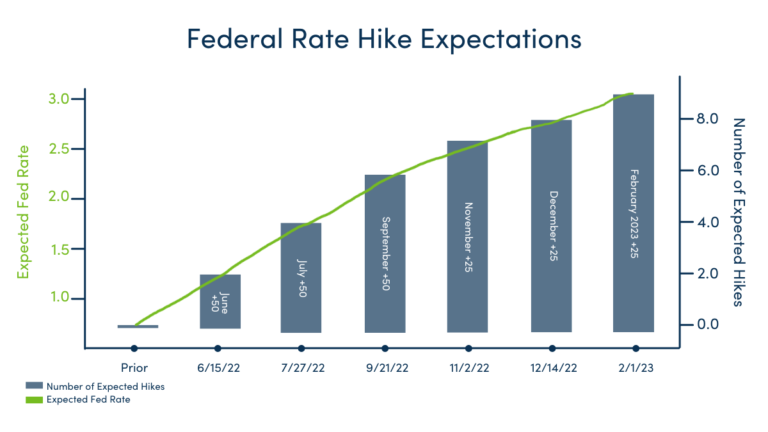

We expected to see something more like a 0.50% increase for June and July. In fact, 0.75% is the biggest rate hike in about 28 years. Chair of the Federal Reserve, Jerome Powell noted, “Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common.” However, he added that he expects the July meeting to see an another increase of 50 or 75 basis points. In fact, increases are to be expected for at least the remainder of 2022. The Federal Open Market Committee (FOMC) members indicated a much stronger path of rate increases ahead to counter inflation. The chart below indicates the anticipated trend, which is moving at its fastest pace since December 1981, according to one commonly cited measure.

The Fed’s benchmark rate will end the year at 3.4%, according to the midpoint of the target range of individual members’ expectations. That reflects an upward revision of 1.5 percentage points from the March estimate. The committee then sees the rate rising to 3.8% in 2023, a full percentage point higher than what was expected in March.

2022 Growth Outlook

Economically, we’re in a unique period of time because of lingering effects of Covid-19. Gross Domestic Products (GDP), which measures price changes in goods/services purchased by consumers, businesses, government, and foreigners, is down (in-part due to supply chain issues). On the other hand, the Consumer Price Index (CPI), which measures the price changes in goods/services purchased out of pocket by urban consumers is up (in part due to the fact that we haven’t been able to travel/spend for the last two years).

Decreased GDP

Increased Personal Expenditures

Core Inflation is Leveling

Core PCE inflation ran at 4.9% in April, so the projections Wednesday anticipate an easing of price pressures in coming months.

“Overall economic activity appears to have picked up after edging down in the first quarter,” the Fed’s Open Market Committee statement said. “Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” Interestingly, the estimates as expressed through the committee’s summary projects inflation sharply lower in 2023, down to 2.6%, expectations that are little changed from March.

Longer term, the FOMC’s outlook largely matches market projections which suggests a series of increases ahead that would take the funds rate to about 3.8%, its highest level since late 2007.

‘Strongly Committed’ to 2% Inflation Goal

Inflation is higher now than it has been in more than 40 years. The Federal Reserve rate hike(s) is designed to try to slow down the economy so supply can catch up with demand. For a long time, the FOMC has expressed an expectation for “inflation to return to its 2 percent objective and the labor market to remain strong.” Now, their statement only noted that the Fed “is strongly committed” to the goal.

The policy tightening is happening with economic growth already tailing off while prices still rise, a condition known as stagflation. This is a term not used much since the 1970’s where the inflation rate is high, economic growth slows, and unemployment remains steadily high. It could be called recession-inflation.

Obviously as we move forward, these factors will impact individuals, business activity, and the markets. Eventually interest rates on fixed investments could be affected too. If you’d like to remain in-the-know, please sign up for our newsletter on related wealth management topics.

Earl Blackmon, CPA

Avizo Group offers Wealth Management for clients who would like assistance in investing, saving, and portfolio diversification. This is an area of need for many of our clients who want to invest but need someone they know and trust to help them. Earl Blackmon holds a Series 7 and Series 66 license.