Retirement savings accounts offer significant tax advantages to encourage people to save during their working years. Some of these account rules include required minimum distributions (RMDs) to ensure that pretax savings are eventually withdrawn and taxed. The legislation enacted in the SECURE Act 2.0 is intended to help strengthen the retirement system. The SECURE Act 2.0 included many changes; one of the significant changes consists of the age for required minimum distributions (RMD) to help people plan for longer careers and longer retirements.

The SECURE Act of 2019 changed the age at which RMDs begin from 70½ to 72. Secure Act 2.0 increases the age at which RMDs start to age 73 for those individuals who turn 72 on or after January 1, 2023. Notably, an individual under age 72 in 2023 is not required to take an RMD for 2023. The RMD age changes again in 2033 from 73 to 75. Individuals can postpone taking their first RMD if they continue to work full or part-time for the employer offering the plan. RMDs continue for the retirement account owner’s lifetime and generally affect the account’s beneficiaries.

2024 Information

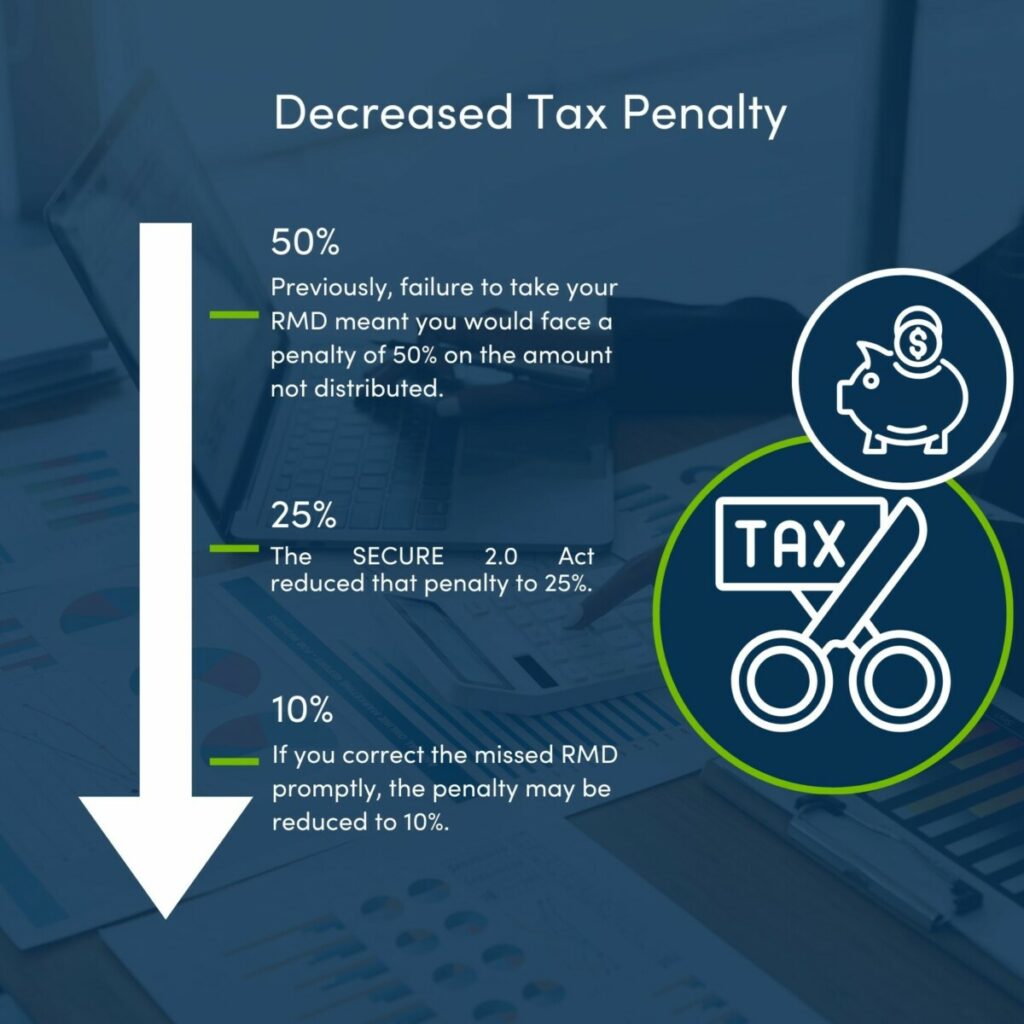

In 2024, investors with a Roth 401(k) or Roth 403(b) will no longer need to take RMDs. (If an investor is 73 years or older in 2023, however, they still are subject to Roth RMDs in 2023.) The new legislation also reduces the penalty tax for not taking, or taking, less than, your RMD due for the year. Previously, failure to take your RMD (or withdrawing too little or too late) meant you would face a penalty of 50% on the amount not distributed.

The SECURE 2.0 Act reduced that penalty to 25%. If you correct the missed RMD promptly, the penalty may be reduced to 10%. You can take your annual RMD as a lump sum or in any combination of payments as long as you meet the minimum over the year.

A monthly payment may be a good choice for investors who plan to use their RMDs as a source of retirement income. Even though you’ll pay the same amount of income tax no matter when you receive the money, delaying your RMD until year-end gives your money more time to grow tax-deferred.

Statute of Limitations

Unknown to many retirement account owners, to assess IRA penalties, the statute of limitations does not begin until IRS Form 5329 “Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts” is filed (by the account owner). Theis form is used when the IRA owner owes a penalty relating to their IRA. For example, the account owner would use Form 5329 to report the penalty for an RMD that was not taken timely, the 10% early distribution penalty (most pre-age 59 ½ distributions), and the 6% penalty on an excess IRA contribution. When the 5329 is not filed, the statute of limitations period does not start. Therefore, the penalty continues—forever—unless the error is corrected. This creates a problem for the account owner.

To make the process more transparent for those IRA owners who have made specific errors (even those made unwittingly), effective immediately, SECURE 2.0 states that the statute of limitations for a missed RMD (or taking too little), as well as for most excess IRA contributions, starts with the filing of Form 1040 for the year in which the error was made (as opposed to Form 5329). Moreover, for those taxpayers who are not required to file Form 1040, the statute of limitations for such penalties will begin upon their tax filing deadline. SECURE 2.0 also states that for assessing the penalty for a missed RMD or shortfall, the statute of limitations is three years, and for excess IRA contributions, it’s six years. If you would like more information regarding RMD’s, retirement accounts or planning, please reach out to one of our Team members at Avizo.

Hayley Lowe

Hayley is an Analyst at Avizo Group who maintain expertise in tax, assurance, and client accounting services.