The Internal Revenue Service recently issued a reiterated warning to remind business owners to be cautious of scams surrounding the Employee Retention Credit. The IRS says, “While the credit is real, aggressive promoters are wildly misrepresenting and exaggerating who can qualify for the credits.” Anyone who claims an ERC improperly will be required to pay it back – and likely end up paying extra due to penalties and interest. Keep reading to learn more about how to spot a scam and what you should do if you want to claim this credit.

What is the ERC?

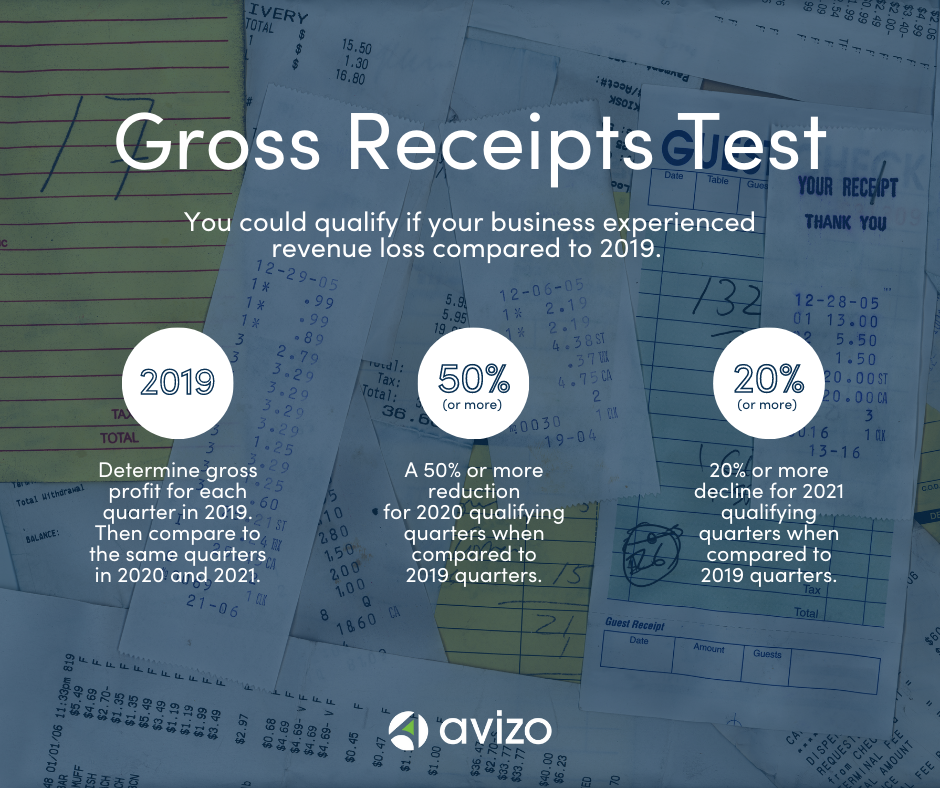

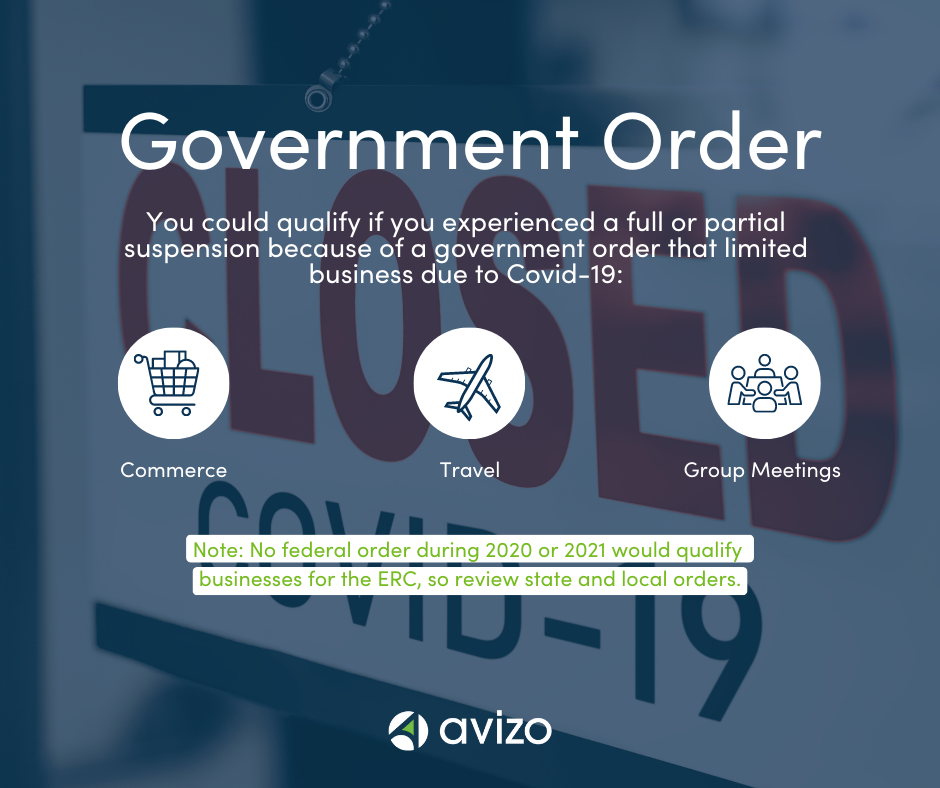

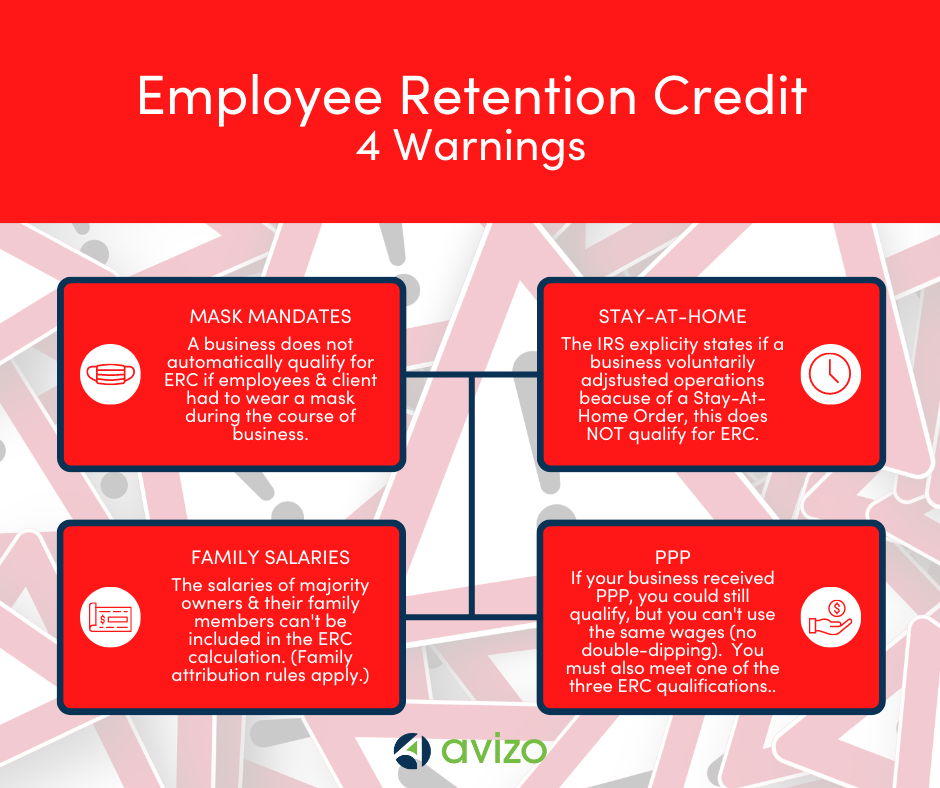

The Employee Retention Credit (ERC) is a refundable payroll-based tax credit for businesses that continued to pay employees while either shut down due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2020 – Dec. 31, 2021. To claim the credit, you will have to file amended 941 forms.

You can still claim the credit now because you have up to 3 years after filing your original Form 941.

- Eligible employers who want to claim ERC funds for Q2, Q3 or Q4 in 2020 must submit their 941-X by April 15, 2024.

- Eligible employers who want to claim ERC funds for Q1, Q2 or Q3 in 2021 must submit their 941-X by April 15, 2025.

How to Identify an Employee Retention Credit Scam

Since there is still more time to file amended 941 Forms, we don’t expect a decrease in the ERC scams anytime soon. Here are a few red flags of what a scammer might say or do while trying to convince you to submit your information for an ERC.

It's Fast! It's Easy!

We've filed ERC for many clients and it's never fast or easy.

Predicting Your Qualification

In reality, the ERC is a complex credit that requires careful review before and throughout submitting an application.

Upfront or Percentage Payment

You WILL have to pay someone to file an ERC, but these methods are unacceptable.

"Why Not?"

However, anyone who claims an ERC improperly will be required to pay it back - and likely end up paying extra due to penalties and interest.

Aggressive Marketing

Don't get roped in. Work with an accounting firm that you know and trust.

Fake Agencies Saying it's Urgent

Inaccurate Eligibility Information

PPP Misinformation

You Can Help Stop the Scammers

If someone has contacted you and any of these red flags are in their communication, the IRS wants you to report them. You can mail or fax a completed Form 14242, Report Suspected Abusive Tax Promotions or Preparers, along with any supporting materials.

Work with An Accountant to File an ERC Claim

The IRS continues to increase their audit and criminal investigation work involving the ERC claims. Business owners should remain vigilant against scammers because it is YOUR responsibility to vet the person helping you. The IRS says, “A business or tax-exempt group could find itself in a much worse cash position if it has to pay back the credit than if the credit was never claimed in the first place. So, it’s important to avoid getting scammed.”

Your best defense is to work with a trusted business tax professional. In addition to filing amended 941-X, the associated tax returns will need to be amended as well, so your accountant is the ideal person to help you with these filings.

If you don’t have an accountant or if yours isn’t well-versed with ERC, our team has training in ERC calculations and guidelines. We’ve already worked with our existing clients to determine their eligibility and to file claims when able. If you think your business is eligible for an ERC and want expert assistance, please click the button below to contact us.